Investor Letter

Source: Wikipedia

**inception date is 1 July 1998

Returns are to 30 June 2024 | Source: Peregrine Capital, Morningstar

the finalization of a Government of National Unity (GNU) including the ANC, DA, IFP and other parties. We believe the GNU gives South Africa the best possible chance to implement structural improvements during the next 5 years. This is especially important given that the other possible coalitions of ANC + EFF or ANC + MK would have put South Africa on a very dangerous economic path.

The performance and stability of our funds during May and June highlight the flexibility of hedge funds and the tools at our disposal to deliver uncorrelated return streams to our investors. We also made extensive use of derivatives during the past 3 months to protect the funds from various downside scenarios that could have transpired as a result of the election. Thankfully this downside protection was never required given the favourable election outcome.

You can trust that we are as driven as ever to continue to find attractive opportunities that will generate strong returns for our investors over the medium term.

The Peregrine Capital funds delivered a pleasing first half of 2024 with net returns of 8% and 6% for High Growth and Pure Hedge qualified funds, respectively. May and June were particularly volatile months in the run-up to the 2024 South African National Government elections followed by the aftermath of coalition politics. We worked especially hard during this period to position the funds to capture some of the upside on a positive election outcome while ensuring that your funds were protected if the downside scenario transpired. Negotiations went down to the wire, but cool heads prevailed in the end, and we are very pleased with

Political and Markets Overview:

Our team spent a large amount of time discussing and debating the various potential outcomes. Domestic South African shares were trading at very low valuations during the first 5 months of the year given this uncertainty. There were three main scenarios we considered during the run-up:

ANC below 45%. Coalition with the DA to reach majority.

This was the best-case scenario, but one that nobody saw as particularly likely before the elections. We knew it was a possibility, but felt it was largely a 50/50 whether the ANC will choose to go with scenario 2 or 3 if they couldn’t get to 50% with the smaller parties.

There has been a tangible divergence in growth, job creation, prosperity and basic service delivery over the past 10 years between the Western Cape (under DA control) vs the rest of the country. This showed clearly that the anti-corruption stance of the DA coupled with good governance could put South African on the right path.

ANC below 45%. Coalition with the EFF to reach majority.

This was the worst case scenario. The extreme leftist ideology of the EFF would negatively impact any potential government that could be formed. We felt that this scenario would be a very negative one for South Africa – it is clear for all to see in many other African countries what the outcomes are of land expropriation and nationalisation policies that the EFF is in favour of. We did not know exactly what would transpire given that the EFF would still only be a minority party – but let’s just say that we are very happy that we don’t have to find out what South Africa would have looked like after 5 years of this.

ANC gets 45 – 48% of the vote

In this scenario the ANC would be able to reach a > 50% majority with a few smaller parties but would retain effective control. This was the middle-of-the-road scenario, and in this case, the next 5 years would likely look a lot like the previous 5 years. More of the same.

We felt that if this scenario transpired, there would be some upside to domestic SA shares such as banks, retailers, and various small and mid-cap shares. The mere removal of the election uncertainty would likely lead to some moderate recovery.

The story of the first half of 2024 was the South African National Government election. In the run-up to the election, it was clear from the polls that it would be the first election since 1994 where the ANC would not win an outright majority. As such, the first 5 months of the year were characterised by speculation and analysis of various election outcomes and how they would impact the future of South Africa.

The following section aims to provide you with some insight into how we saw things before the elections, during the month following the elections until the final formation of the GNU, and how we see things going forward.

Source: Electoral Commission of South Africa (IEC):

Our president announced the new cabinet at 22:00 on the 30th of June! We finally had confirmation of our first multi-party government since the formation of our constitutional democracy in 1994. Few people in South Africa seem to grasp the significance of an African liberation movement accepting defeat and having the courage to form a new government with reform and growth-minded opposition parties. What an incredible moment for South Africa! While it is early days, there are real reasons to be optimistic that this will lead to better things for our beautiful country.

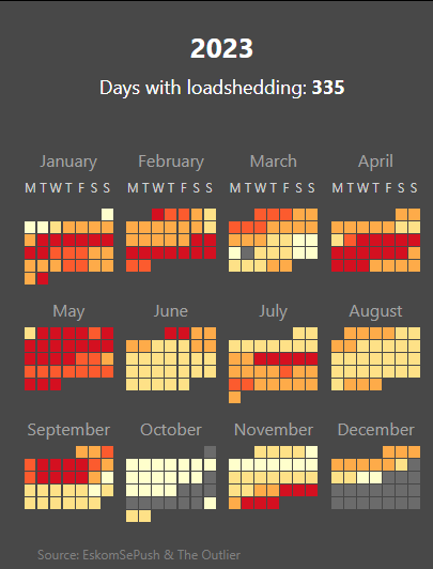

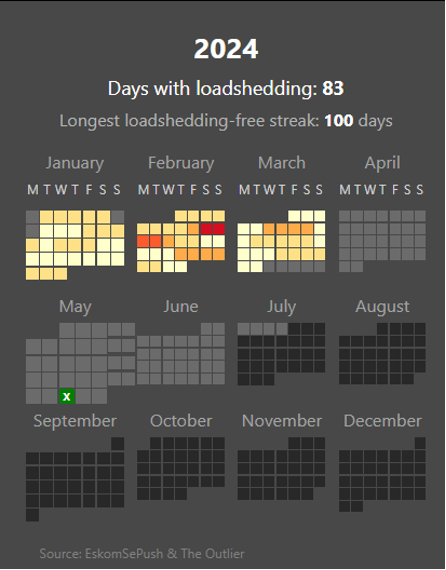

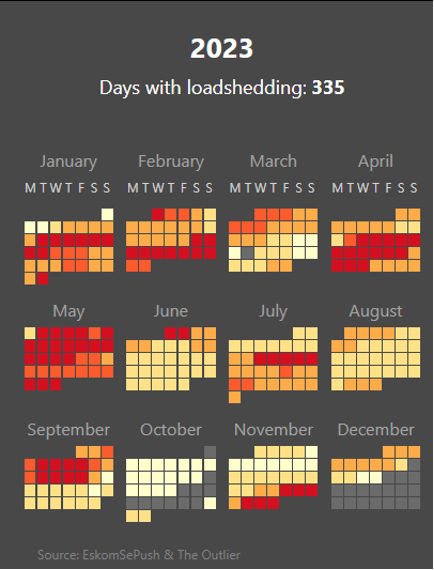

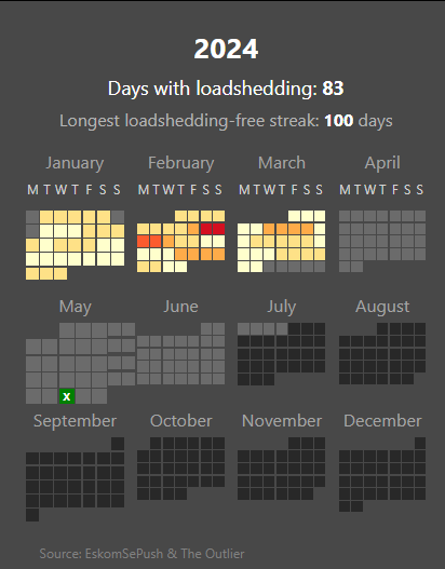

A year ago, almost anyone would have told you that South Africa was going to be stuck in permanent Stage 6 loadshedding with non-stop talk about a Grid collapse and 6 weeks without power.

Our job now moves to best managing the portfolio in this new era for South Africa. We will continue what we have done for the past 26 years: Identify mispriced shares that will deliver great absolute returns to our investors. And as a business based in South Africa, we will do the best we can to help our nation succeed and prosper!

By appointing qualified, driven, and honest people to positions of authority, this is the best chance our country has had in many years to reignite growth, prosperity and more importantly, to create the jobs that the South African population really needs. An excellent illustration of this is Eskom. A year ago, almost anyone would have told you that South Africa was going to be stuck in permanent Stage 6 loadshedding with non-stop talk about a Grid collapse and 6 weeks without power. In the end, this was poorly researched, consensus thinking. Our research indicated things could and were improving, and Eskom has surprised even our hopeful expectations. As at 30 June South Africa has had 96 consecutive days without “loadshedding”!

The market then entered a period of wild swings. The first move was down as people feared that Scenario 1 was off the table, and we were now staring down Scenario 2 or 3.

The first weekend of discussions between parties surprised everyone. It became clear that the EFF and MK were on the outside, as parties with radical views that did not respect the principles of the South African constitution. This moved the ANC towards the DA / IFP and other smaller parties.

The president was elected with the assistance of these reform minded parties. Markets were over-joyed, and domestic shares performed very well for the next week.

We then entered a period of uncertainty yet again. The GNU had been announced, but discussions still had to take place to decide who would get what positions in the new SA cabinet. The DA wanted ministries to reflect their meaningful share of the national vote (more than half of what the ANC received). The ANC wanted to retain as much control as possible and wanted to give away as little as they could.

We watched the markets and political events while tweaking our positioning on almost a daily basis during this period. It stands out as a unique period in our history, and probably one where we were most focussed on politics in our entire 26 years that we have been managing money (we prefer to spend most of our time analysing companies and not politics!). There were daily leaks of letters, rumours of behind-the-scenes discussions, and unending drama! It was an exceptionally interesting period and again, we are very glad to have had the full hedge-fund toolkit at our disposal during this time.

We had to blend long-term views with short-term risk management, all while probabilities of the various outcomes continued to move around. We ended the wild month of June up 3.05% in High Growth and 1.60% in Pure Hedge, a reasonably good result given we had to both try to capture the upside of a good outcome, but also ensure that the funds would be protected if negotiations fell apart at the last minute.

The two major surprises from election day were how much support the MK party received in KwaZulu-Natal and just how poorly the ANC performed, with 40.18% of the final national vote, way below what most had expected. The ANC accepted the electoral defeat with grace and humility, setting the foundation for our new reality – South Africa had become a nation where coalition politics would determine the future trajectory of the country.

While it is early days, there are real reasons to be optimistic that this will lead to better things for our beautiful country.

South Africa had become a nation where coalition politics would determine the future trajectory of the country.

In the run-up to the election, it was clear from the polls that it would be the first election since 1994 where the ANC would not win an outright majority.

Looking Ahead

We are under no illusion that coalition politics will not be an easy ride for South Africa but we are encouraged by the number and speed of reforms made in the last 9 months, especially in the energy and logistics sectors.

With Thanks

Please contact us via info@peregrine.co.za if you have any questions or comments.

Name | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 5 years | Latest 10 years |

|---|---|---|---|---|---|---|

High Growth Fund | Feb-00 | 53.01% (2004) | -11.98% (2008) | 15.71% | 12.81% | 14.01% |

FTSE/JSE Capped Swix All Share Index | Feb-00 | 47.25% (2005) | -23.23% (2008) | 10.04% | 8.74% | 6.22% |

ASISA South Africa MA High Equity | Feb-00 | 27.49% (2004) | -8.24% (2008) | 9.81% | 8.95% | 6.90% |

Pure Hedge Fund | Jul-1998 | 67.90% (1999) | 1.61% (2008) | 12.76% | 10.52% | 11.86% |

Inflation (CPI) | Jul-1998 | 12.97% (2002) | 0.21% (2008) | 5.20% | 5.04% | 5.03% |

ASISA South Africa MA Low Equity | Jul-1998 | 40.59% (1999) | -10.69% (2008) | 9.48% | 7.99% | 6.98% |

Important Information

Data to 30 June 2024 | Source: Peregrine Capital, IRESS, Bloomberg.

Investor Letter

Our job now moves to best managing the portfolio in this new era for South Africa. We will continue what we have done for the past 26 years: Identify mispriced shares that will deliver great absolute returns to our investors. And as a business based in South Africa, we will do the best we can to help our nation succeed and prosper!

A year ago, almost anyone would have told you that South Africa was going to be stuck in permanent Stage 6 loadshedding with non-stop talk about a Grid collapse and 6 weeks without power.

Source: Wikipedia

While it is early days, there are real reasons to be optimistic that this will lead to better things for our beautiful country.

Our president announced the new cabinet at 22:00 on the 30th of June! We finally had confirmation of our first multi-party government since the formation of our constitutional democracy in 1994. Few people in South Africa seem to grasp the significance of an African liberation movement accepting defeat and having the courage to form a new government with reform and growth-minded opposition parties. What an incredible moment for South Africa! While it is early days, there are real reasons to be optimistic that this will lead to better things for our beautiful country.

The market then entered a period of wild swings. The first move was down as people feared that Scenario 1 was off the table, and we were now staring down Scenario 2 or 3.

The first weekend of discussions between parties surprised everyone. It became clear that the EFF and MK were on the outside, as parties with radical views that did not respect the principles of the South African constitution. This moved the ANC towards the DA / IFP and other smaller parties.

The president was elected with the assistance of these reform minded parties. Markets were over-joyed, and domestic shares performed very well for the next week.

We then entered a period of uncertainty yet again. The GNU had been announced, but discussions still had to take place to decide who would get what positions in the new SA cabinet. The DA wanted ministries to reflect their meaningful share of the national vote (more than half of what the ANC received). The ANC wanted to retain as much control as possible and wanted to give away as little as they could.

We watched the markets and political events while tweaking our positioning on almost a daily basis during this period. It stands out as a unique period in our history, and probably one where we were most focussed on politics in our entire 26 years that we have been managing money (we prefer to spend most of our time analysing companies and not politics!). There were daily leaks of letters, rumours of behind-the-scenes discussions, and unending drama! It was an exceptionally interesting period and again, we are very glad to have had the full hedge-fund toolkit at our disposal during this time.

We had to blend long-term views with short-term risk management, all while probabilities of the various outcomes continued to move around. We ended the wild month of June up 3.05% in High Growth and 1.60% in Pure Hedge, a reasonably good result given we had to both try to capture the upside of a good outcome, but also ensure that the funds would be protected if negotiations fell apart at the last minute.

Source: Electoral Commission of South Africa (IEC):

The two major surprises from election day were how much support the MK party received in KwaZulu-Natal and just how poorly the ANC performed, with 40.18% of the final national vote, way below what most had expected. The ANC accepted the electoral defeat with grace and humility, setting the foundation for our new reality – South Africa had become a nation where coalition politics would determine the future trajectory of the country.

South Africa had become a nation where coalition politics would determine the future trajectory of the country.

In the run-up to the election, it was clear from the polls that it would be the first election since 1994 where the ANC would not win an outright majority.

Our team spent a large amount of time discussing and debating the various potential outcomes. Domestic South African shares were trading at very low valuations during the first 5 months of the year given this uncertainty. There were three main scenarios we considered during the run-up:

The story of the first half of 2024 was the South African National Government election. In the run-up to the election, it was clear from the polls that it would be the first election since 1994 where the ANC would not win an outright majority. As such, the first 5 months of the year were characterised by speculation and analysis of various election outcomes and how they would impact the future of South Africa.

The following section aims to provide you with some insight into how we saw things before the elections, during the month following the elections until the final formation of the GNU, and how we see things going forward.

Political and Markets Overview:

ANC gets 45 – 48% of the vote

In this scenario the ANC would be able to reach a > 50% majority with a few smaller parties but would retain effective control. This was the middle-of-the-road scenario, and in this case, the next 5 years would likely look a lot like the previous 5 years. More of the same.

We felt that if this scenario transpired, there would be some upside to domestic SA shares such as banks, retailers, and various small and mid-cap shares. The mere removal of the election uncertainty would likely lead to some moderate recovery.

ANC below 45%. Coalition with the DA to reach majority.

This was the best-case scenario, but one that nobody saw as particularly likely before the elections. We knew it was a possibility, but felt it was largely a 50/50 whether the ANC will choose to go with scenario 2 or 3 if they couldn’t get to 50% with the smaller parties.

There has been a tangible divergence in growth, job creation, prosperity and basic service delivery over the past 10 years between the Western Cape (under DA control) vs the rest of the country. This showed clearly that the anti-corruption stance of the DA coupled with good governance could put South African on the right path.

ANC below 45%. Coalition with the EFF to reach majority.

This was the worst case scenario. The extreme leftist ideology of the EFF would negatively impact any potential government that could be formed. We felt that this scenario would be a very negative one for South Africa – it is clear for all to see in many other African countries what the outcomes are of land expropriation and nationalisation policies that the EFF is in favour of. We did not know exactly what would transpire given that the EFF would still only be a minority party – but let’s just say that we are very happy that we don’t have to find out what South Africa would have looked like after 5 years of this.

By appointing qualified, driven, and honest people to positions of authority, this is the best chance our country has had in many years to reignite growth, prosperity and more importantly, to create the jobs that the South African population really needs. An excellent illustration of this is Eskom. A year ago, almost anyone would have told you that South Africa was going to be stuck in permanent Stage 6 loadshedding with non-stop talk about a Grid collapse and 6 weeks without power. In the end, this was poorly researched, consensus thinking. Our research indicated things could and were improving, and Eskom has surprised even our hopeful expectations. As at 30 June South Africa has had 96 consecutive days without “loadshedding”!

The Peregrine Capital funds delivered a pleasing first half of 2024 with net returns of 8% and 6% for High Growth and Pure Hedge qualified funds, respectively. May and June were particularly volatile months in the run-up to the 2024 South African National Government elections followed by the aftermath of coalition politics. We worked especially hard during this period to position the funds to capture some of the upside on a positive election outcome while ensuring that your funds were protected if the downside scenario transpired. Negotiations went down to the wire, but cool heads prevailed in the end, and we are very pleased with the finalization of a Government of National Unity (GNU) including the ANC, DA, IFP and other parties. We believe the GNU gives South Africa the best possible chance to implement structural improvements during the next 5 years. This is especially important given that the other possible coalitions of ANC + EFF or ANC + MK would have put South Africa on a very dangerous economic path.

The performance and stability of our funds during May and June highlight the flexibility of hedge funds and the tools at our disposal to deliver uncorrelated return streams to our investors. We also made extensive use of derivatives during the past 3 months to protect the funds from various downside scenarios that could have transpired as a result of the election. Thankfully this downside protection was never required given the favourable election outcome.

You can trust that we are as driven as ever to continue to find attractive opportunities that will generate strong returns for our investors over the medium term.

We are under no illusion that coalition politics will not be an easy ride for South Africa but we are encouraged by the number and speed of reforms made in the last 9 months, especially in the energy and logistics sectors.

Looking Ahead

Please contact us via info@peregrine.co.za if you have any questions or comments.

With Thanks

Data to 30 June 2024 | Source: Peregrine Capital, IRESS, Bloomberg.

Name | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 5 years | Latest 10 years |

|---|---|---|---|---|---|---|

High Growth Fund | Feb-00 | 53.01% (2004) | -11.98% (2008) | 15.00% | 11.98% | 14.64% |

FTSE/JSE Capped Swix All Share Index | Feb-00 | 47.25% (2005) | -23.23% (2008) | 13.47% | 6.91% | 8.23% |

ASISA South Africa MA High Equity | Feb-00 | 27.49% (2004) | -8.24% (2008) | 16.51% | 7.61% | 7.81% |

Pure Hedge Fund | Jul-1998 | 67.90% (1999) | 1.61% (2008) | 14.18% | 10.86% | 11.79% |

Inflation (CPI) | Jul-1998 | 12.97% (2002) | 0.21% (2008) | 6.00% | 4.89% | 5.16% |

ASISA South Africa MA Low Equity | Jul-1998 | 40.59% (1999) | -10.69% (2008) | 14.49% | 7.19% | 7.25% |

Important Information