This doesn’t mean that South Africa goes straight to 3-5% economic growth. Significant challenges remain to unleash the true economic potential of our country. Challenges will remain in electricity transmission and distribution, water infrastructure, municipal governance, corruption, and the systemic and treasonous sabotage of our infrastructure. However, the potential resolution of the electricity crisis over a reasonably short period by government and the private sector working together could provide a playbook to resolve many of the other challenges facing our country.

Most people will take current trends and assume that they will simply persist going forward. However, our job is to research the future and figure out what the most likely potential outcomes are. Our team has done substantial research on this topic as it is a key variable in the outlook for the SA economy and SA companies we invest in. In short, our “belief” is supported by powerful incentives, a credible plan, and cold, hard facts. We have conviction that power shortages will moderate significantly over the following 12 months and that the energy crisis as we know it will be a thing of the past within the next two years.

From a political perspective, we have national government elections taking place in 2024. Polling data suggest that loadshedding remains the single biggest factor in deciding where voters cast their ballots next year. As the biggest potential “loser”, the ANC recognises this risk to their political supremacy. Private sector companies, in turn, understand that electricity supply is the primary existential threat to their own survival. This realisation is not lost on labour, who also understand the devastating consequences that will result for their constituency if the energy crisis is not resolved. The ideological resistance to private sector participation in energy generation has now crumbled, as the ANC led government has realised that they have neither the funds, nor the internal capacity, to resolve the energy crisis on their own. The incentives are aligned. Government, businesses, and individuals want to resolve this.

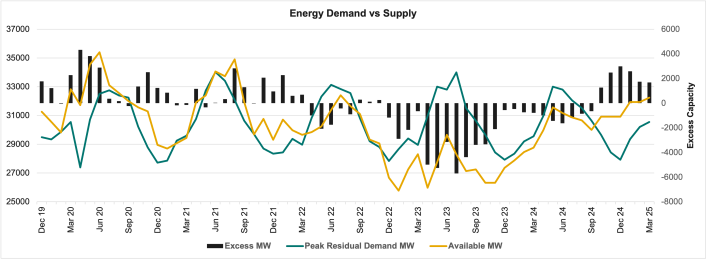

Powerful incentives will ultimately prove worthless without an actionable plan. We are pleased to report that such a plan exists, and that some major impediments to the structural reforms that we anticipate have already been resolved. While Eskom’s internal plans to improve plant performance and to procure additional supply are most welcome (and likely deliver short-term relief), it is the legislative amendment to remove the cap on private electricity generation projects, that was passed in December 2022, that will make all the difference over the medium term. This seemingly small change will unleash private sector capital and expertise to generate power for their own use, which materially improves aggregate supply of electricity, but also establishes a more durable and diversified generation fleet for the long run.

Plans are meaningless unless they are supported by efficient and timeous execution that delivers tangible results. It is time for us to evaluate some cold, hard facts:

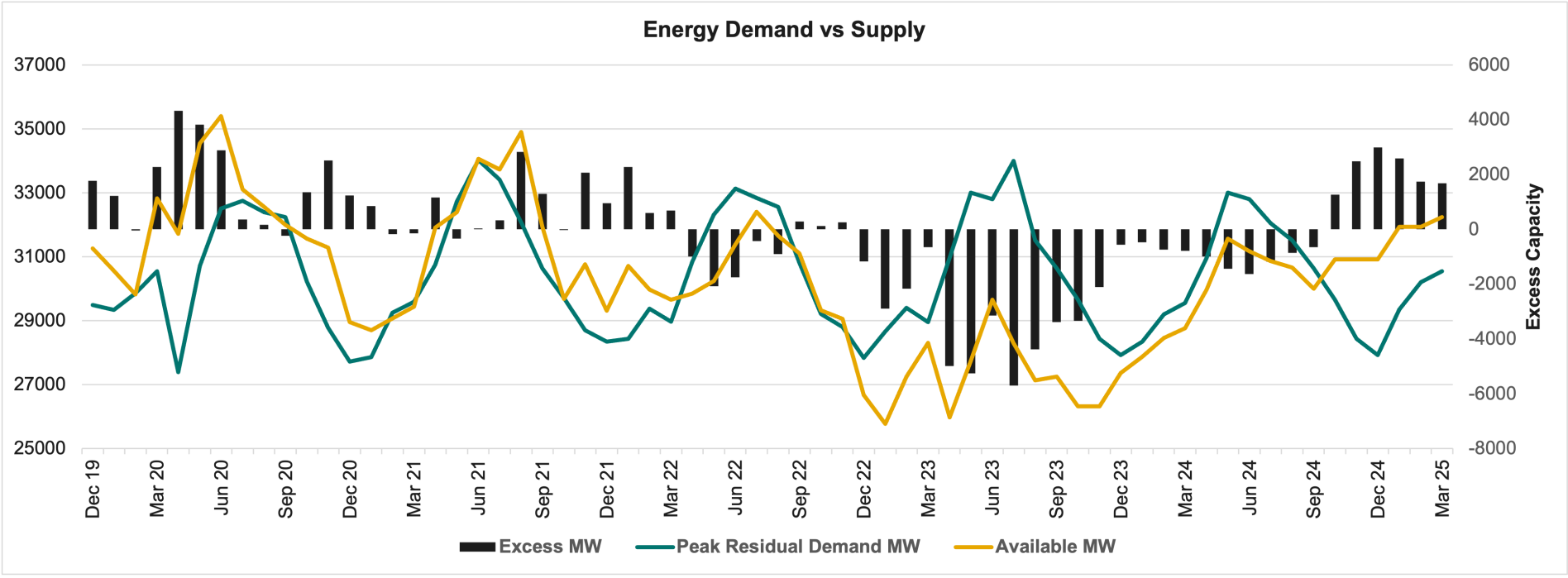

Eskom currently has approximately 50GW of installed generation capacity, accounts for 90% of electricity generation in South Africa, but only produces 26-27GW of reliable supply.

Aggregate peak demand in the country is approximately 32GW and as such, we had a 5-6GW shortfall on any given day during peak loadshedding periods in the first half of 2023.

While capacity is clearly constrained, there are three major sources of supply that will materially reduce loadshedding in the short run:

Eskom expects multiple units at Medupi and Kusile to return to service between November 2023 and March 2024, and the second unit at Koeberg by June 2024, resulting in the return of 4.5GW of baseload power to the grid over the next 12 months.

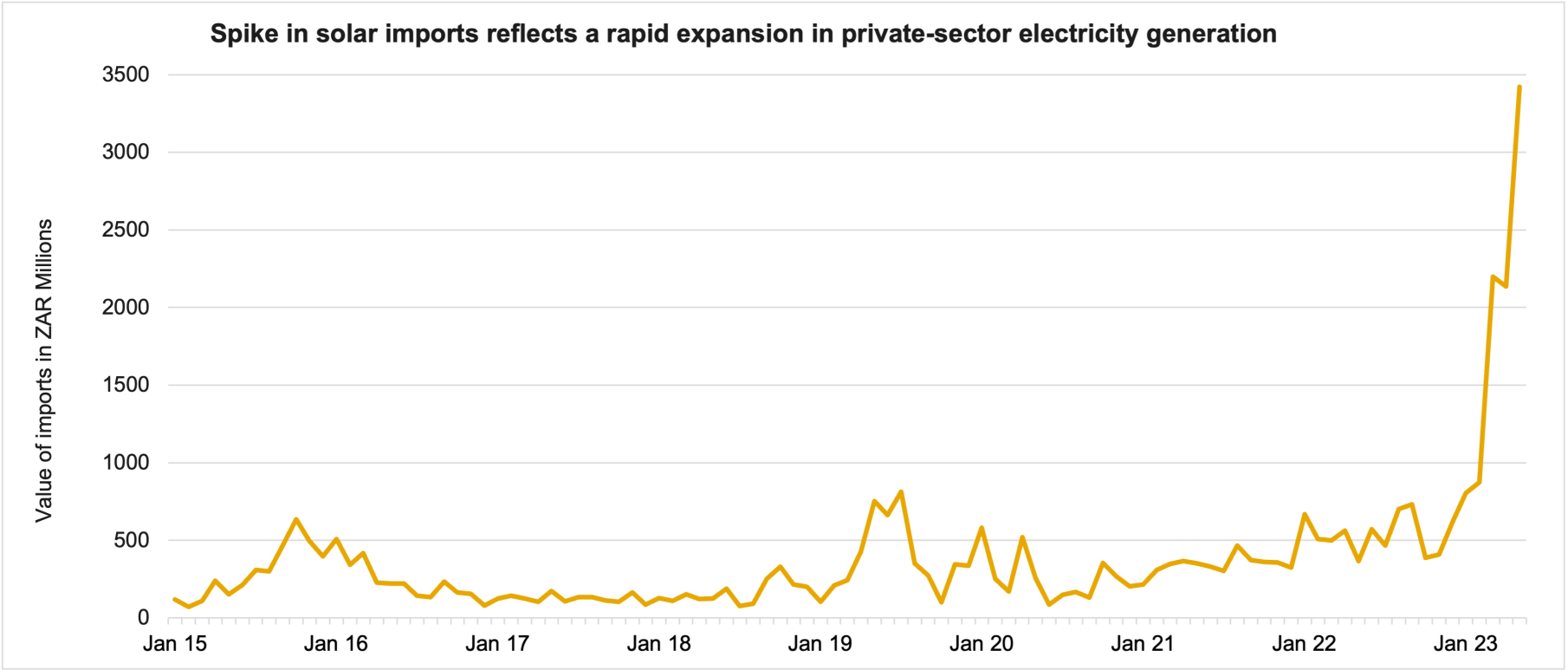

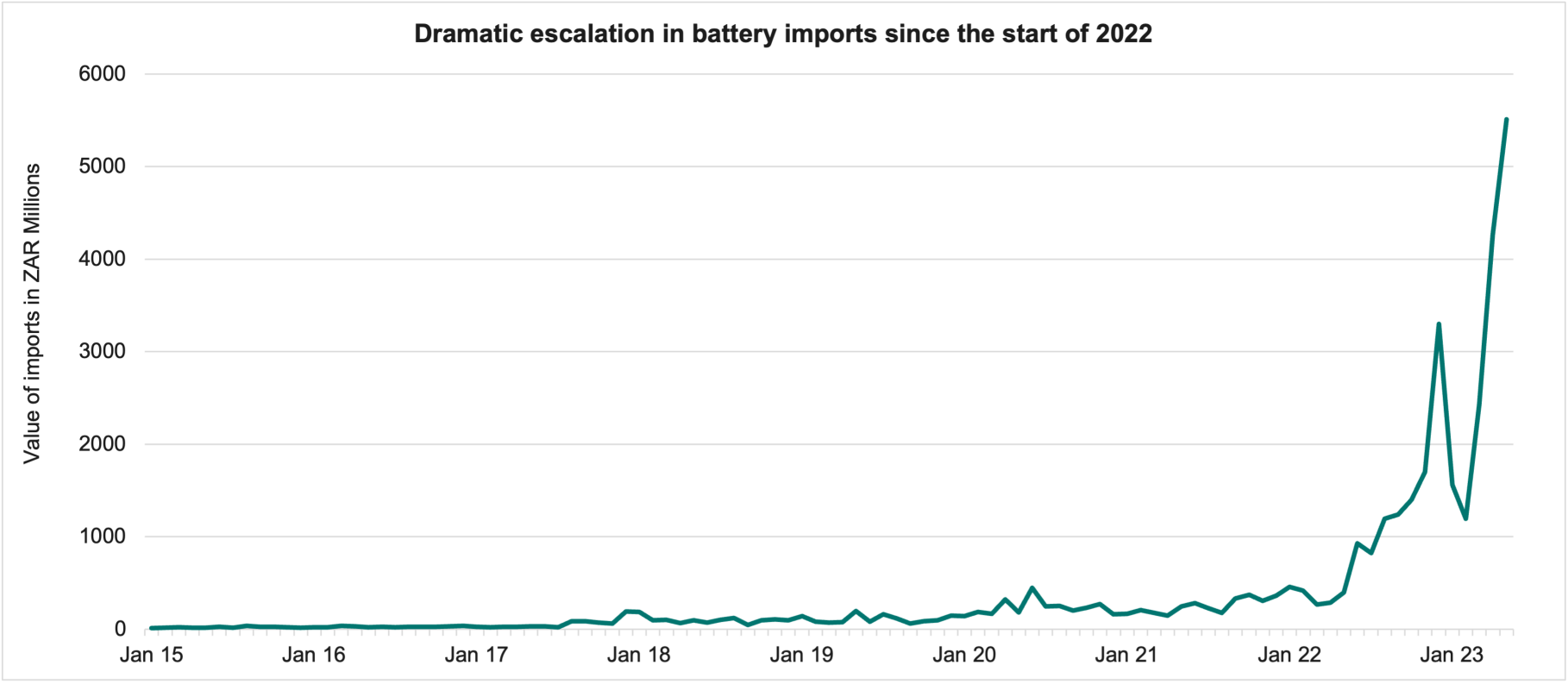

Rooftop solar installations are likely to add a further 2-3GW of additional capacity to the grid this year, per data from the Presidency, and

Large scale private sector projects are likely to add 1.3GW of new supply to the grid in 2023, 3.1GW in 2024, and this pipeline grows further in 2025/6.

Over and above these major drivers there are additional shorter term wins available:

3 Karpowerships could provide 1.2 GW per year over a 5 year period to resolve some short-term stress.

South Africa is busy negotiating a 1 GW per annum power purchase agreement with Mozambique using gas-fired power plants.

In the longer run, legislative reforms to establish a competitive electricity market, and the unbundling and subsequent investments in the transmission network are likely to unleash hundreds of billions of Rands worth of private sector investment in electricity generation. There have been numbers thrown out as high as 66GW per a recent Eskom survey. While we don’t think all of this will be commissioned, it is more than enough to permanently resolve the loadshedding situation, and it is this fact that supports our confidence in the longer-term earnings trajectory of South African businesses.

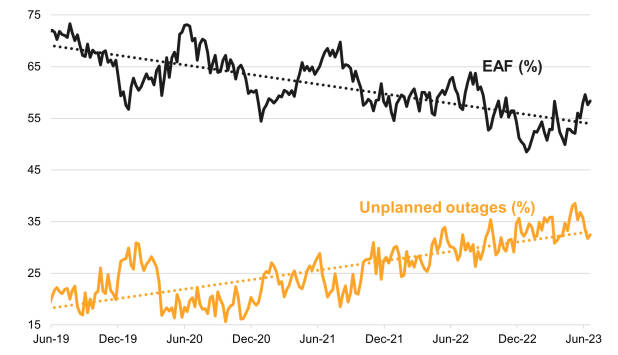

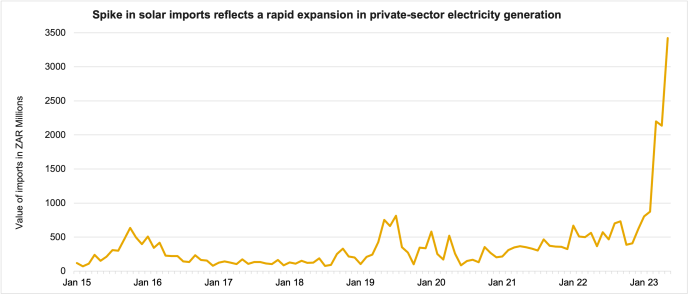

The graph below indicates our current forecasts of electricity supply and demand. The key uncertainty to the picture is the EAF of the current fleet. We believe we are being conservative in our forecast, but the end result could still be above or below our estimate. Even if Eskom’s performance is somewhat worse, we believe the private sector investments will simply increase to offset this. The research we have done leaves us in a position where we believe the major stumbling block to SA growth and investor confidence will be resolved.

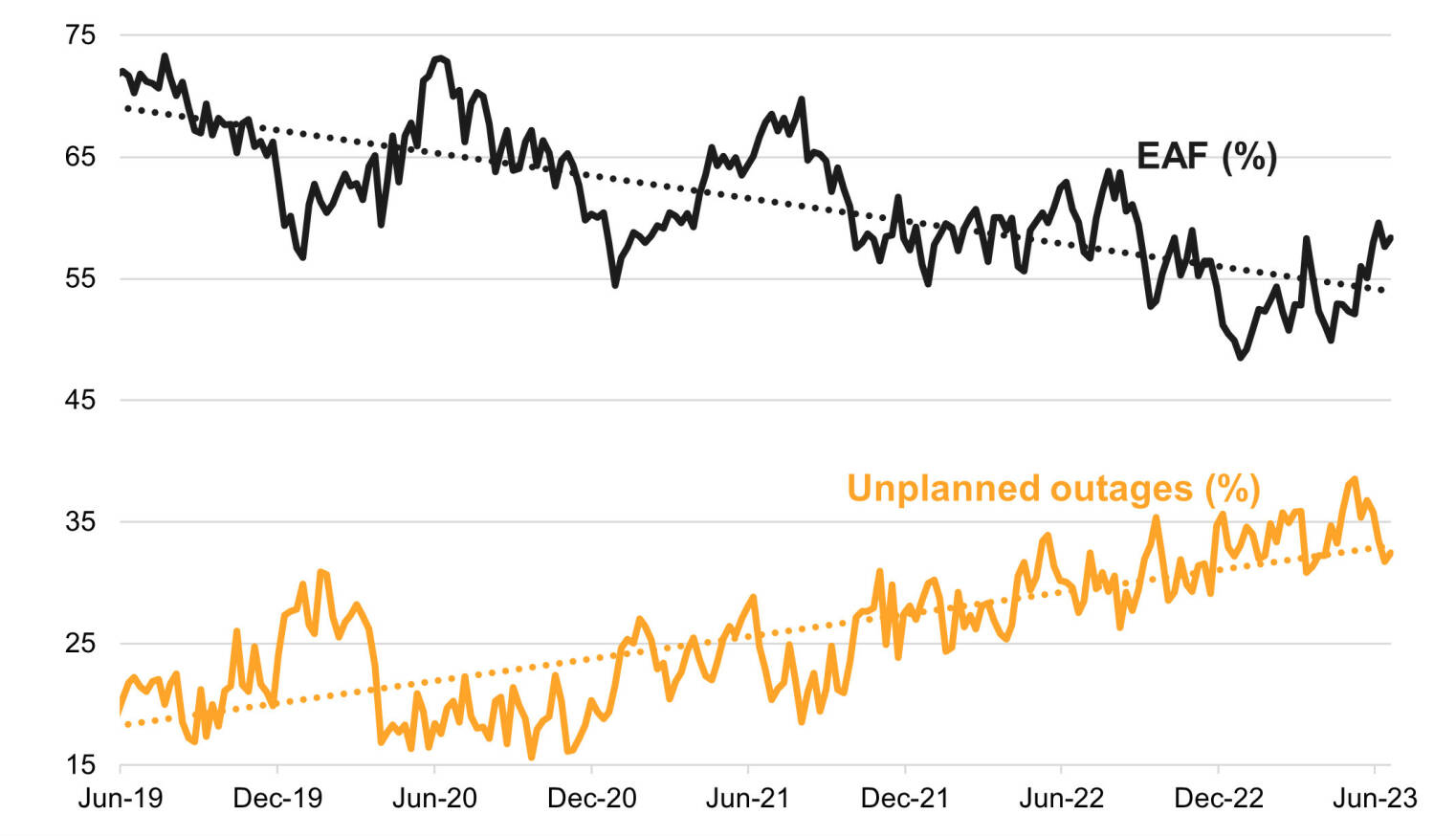

REACHING NEW LOWS: THE DECLINING EAF TREND

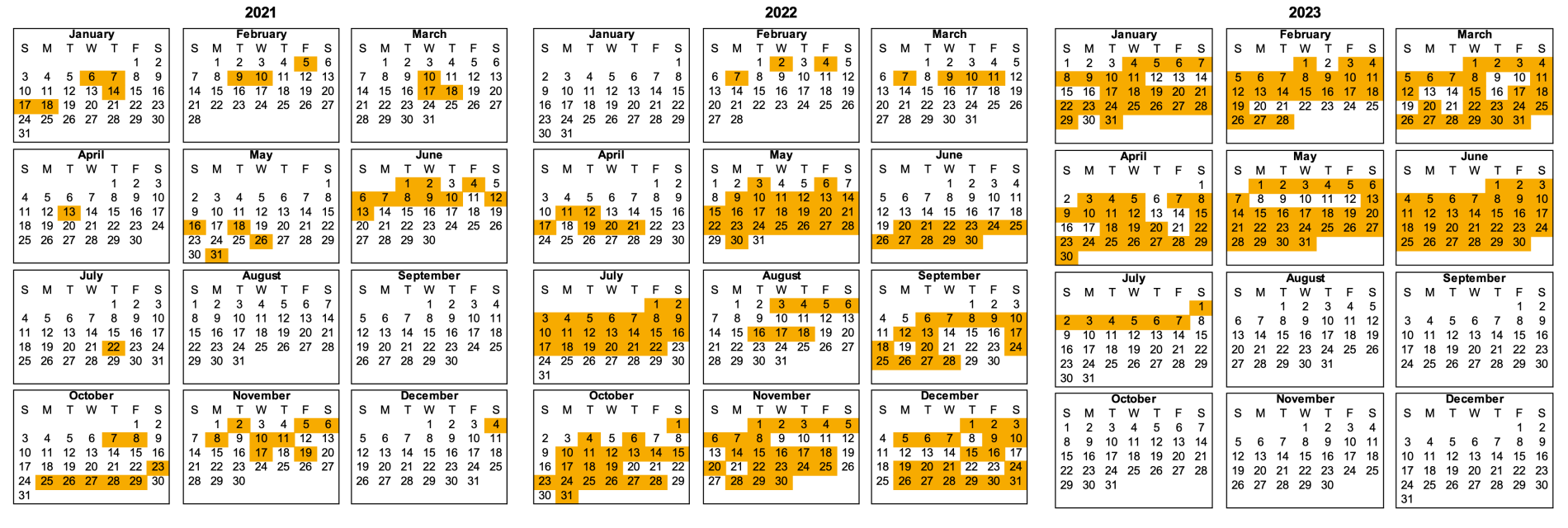

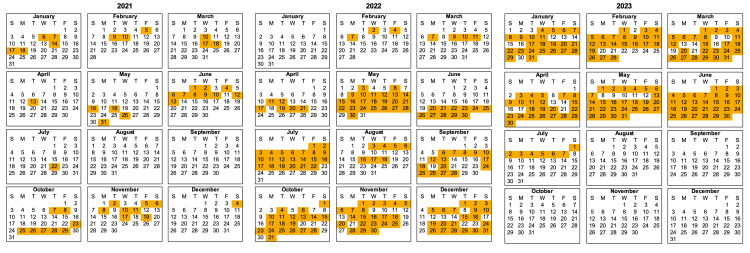

DAYS WE EXPERIENCED LOADSHEDDING

The drop in the EAF has meant that there simply hasn’t been enough power to satisfy demand, leading to a massive increase in the amount of loadshedding experienced in SA since October 2022.

If there is a single topic that occupies the minds and dinner table conversations of all South Africans, it is loadshedding. From businesses to households to political parties and to the average person on the street, none of us is spared from the devastating effects of the rolling electricity blackouts that seem to get worse with each passing year. Some clients regularly question how Peregrine Capital can continue to invest in JSE-listed shares with material exposure to the crumbling South African economy?

Why are we here?

Years of mismanagement and corruption have resulted in a precipitous plunge in the ability of Eskom to generate power. This is managed by the Energy Available Factor (EAF). The amount of power produced represented as a percentage of the total installed capacity at Eskom. This picture tells the story clearly.

This doesn’t mean that South Africa goes straight to 3-5% economic growth. Significant challenges remain to unleash the true economic potential of our country. Challenges will remain in electricity transmission and distribution, water infrastructure, municipal governance, corruption, and the systemic and treasonous sabotage of our infrastructure. However, the potential resolution of the electricity crisis over a reasonably short period by government and the private sector working together could provide a playbook to resolve many of the other challenges facing our country.

In the longer run, legislative reforms to establish a competitive electricity market, and the unbundling and subsequent investments in the transmission network are likely to unleash hundreds of billions of Rands worth of private sector investment in electricity generation. There have been numbers thrown out as high as 66GW per a recent Eskom survey. While we don’t think all of this will be commissioned, it is more than enough to permanently resolve the loadshedding situation, and it is this fact that supports our confidence in the longer-term earnings trajectory of South African businesses.

The graph below indicates our current forecasts of electricity supply and demand. The key uncertainty to the picture is the EAF of the current fleet. We believe we are being conservative in our forecast, but the end result could still be above or below our estimate. Even if Eskom’s performance is somewhat worse, we believe the private sector investments will simply increase to offset this. The research we have done leaves us in a position where we believe the major stumbling block to SA growth and investor confidence will be resolved.

DAYS WE EXPERIENCED LOADSHEDDING

If there is a single topic that occupies the minds and dinner table conversations of all South Africans, it is loadshedding. From businesses to households to political parties and to the average person on the street, none of us is spared from the devastating effects of the rolling electricity blackouts that seem to get worse with each passing year. Some clients regularly question how Peregrine Capital can continue to invest in JSE-listed shares with material exposure to the crumbling South African economy?

Why are we here?

Years of mismanagement and corruption have resulted in a precipitous plunge in the ability of Eskom to generate power. This is managed by the Energy Available Factor (EAF). The amount of power produced represented as a percentage of the total installed capacity at Eskom. This picture tells the story clearly.

Most people will take current trends and assume that they will simply persist going forward. However, our job is to research the future and figure out what the most likely potential outcomes are. Our team has done substantial research on this topic as it is a key variable in the outlook for the SA economy and SA companies we invest in. In short, our “belief” is supported by powerful incentives, a credible plan, and cold, hard facts. We have conviction that power shortages will moderate significantly over the following 12 months and that the energy crisis as we know it will be a thing of the past within the next two years.

From a political perspective, we have national government elections taking place in 2024. Polling data suggest that loadshedding remains the single biggest factor in deciding where voters cast their ballots next year. As the biggest potential “loser”, the ANC recognises this risk to their political supremacy. Private sector companies, in turn, understand that electricity supply is the primary existential threat to their own survival. This realisation is not lost on labour, who also understand the devastating consequences that will result for their constituency if the energy crisis is not resolved. The ideological resistance to private sector participation in energy generation has now crumbled, as the ANC led government has realised that they have neither the funds, nor the internal capacity, to resolve the energy crisis on their own. The incentives are aligned. Government, businesses, and individuals want to resolve this.

Powerful incentives will ultimately prove worthless without an actionable plan. We are pleased to report that such a plan exists, and that some major impediments to the structural reforms that we anticipate have already been resolved. While Eskom’s internal plans to improve plant performance and to procure additional supply are most welcome (and likely deliver short-term relief), it is the legislative amendment to remove the cap on private electricity generation projects, that was passed in December 2022, that will make all the difference over the medium term. This seemingly small change will unleash private sector capital and expertise to generate power for their own use, which materially improves aggregate supply of electricity, but also establishes a more durable and diversified generation fleet for the long run.

Plans are meaningless unless they are supported by efficient and timeous execution that delivers tangible results. It is time for us to evaluate some cold, hard facts:

Eskom currently has approximately 50GW of installed generation capacity, accounts for 90% of electricity generation in South Africa, but only produces 26-27GW of reliable supply.

Aggregate peak demand in the country is approximately 32GW and as such, we had a 5-6GW shortfall on any given day during peak loadshedding periods in the first half of 2023.

While capacity is clearly constrained, there are three major sources of supply that will materially reduce loadshedding in the short run:

Eskom expects multiple units at Medupi and Kusile to return to service between November 2023 and March 2024, and the second unit at Koeberg by June 2024, resulting in the return of 4.5GW of baseload power to the grid over the next 12 months.

Rooftop solar installations are likely to add a further 2-3GW of additional capacity to the grid this year, per data from the Presidency, and

Large scale private sector projects are likely to add 1.3GW of new supply to the grid in 2023, 3.1GW in 2024, and this pipeline grows further in 2025/6.

Over and above these major drivers there are additional shorter term wins available:

3 Karpowerships could provide 1.2 GW per year over a 5 year period to resolve some short-term stress.

South Africa is busy negotiating a 1 GW per annum power purchase agreement with Mozambique using gas-fired power plants.

REACHING NEW LOWS: THE DECLINING EAF TREND

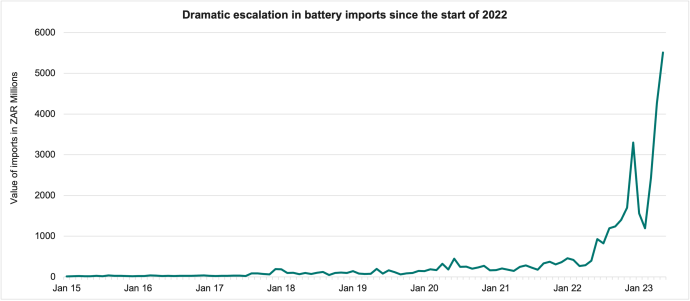

The drop in the EAF has meant that there simply hasn’t been enough power to satisfy demand, leading to a massive increase in the amount of loadshedding experienced in SA since October 2022.