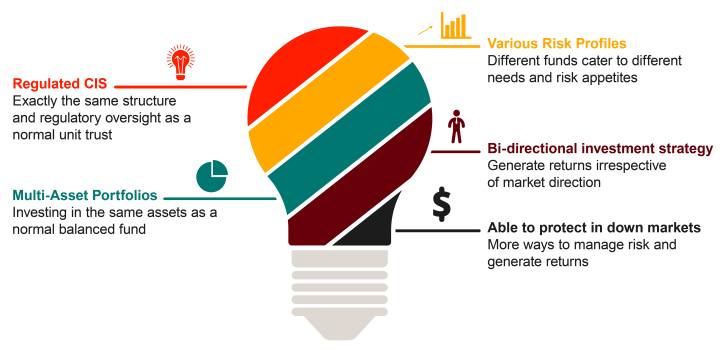

A hedge fund is similar to a unit trust fund but has broader discretion in terms of the types of investments the fund manager can pursue, and a wider set of tools that can be employed to generate returns and manage risk.

At Peregrine Capital, we strive to achieve superior risk-adjusted returns for our clients by drawing on a well-established toolkit; refined over many years through our ever evolving and rigorous investment process. If the available toolkit is used appropriately by an astute fund manager, an effective hedge fund strategy can enhance investor returns, while also managing downside risks.

Most unit trusts strive to outperform a benchmark, whereas hedge funds focus on generating absolute returns and delivering positive returns to clients irrespective of how the broader market performs.

Hedge fund managers have more investment opportunities and tools to generate returns and manage risk.

Similarities & Differences

Like traditional funds, hedge funds are a category of unit trusts, governed by the Financial Sector Conduct Authority (FSCA).

Hedge fund managers can invest in the same asset classes available to traditional unit trust managers.

Unlike unit trusts, hedge funds can extract positive performance in both upward and downward-trending market conditions. This is thanks to a tool in the toolbox of hedge funds called “short selling,” whereby one profits from a decline in share prices.

Hedge funds can apply true bottom-up fundamental research and only invest in companies they believe offer the best return potential and fundamentals.

Unlike long-only unit trusts, most hedge funds do not subscribe to the concept of benchmarking and relative return. This means that hedge fund managers typically focus on absolute risk and return metrics rather than the outperformance or underperformance of a specific benchmark. As a consequence of not being forced to track a benchmark, hedge funds don’t have the incentive to own shares in companies purely because they are part of an index. Instead, hedge funds can apply true bottom-up fundamental research and only invest in companies they believe offer the best return potential and fundamentals.

Absolute Return Focus

Hedge funds mandates are typically constructed to give the fund manager greater discretion to pursue investments across asset classes and geographies, using a wide variety of tools. This allows the fund manager to maximise returns and manage risk. Flexible mandates also enable hedge fund managers to take advantage of special situations that arise in the bond and equity markets, where unit trust managers may be constrained where such situations occur. Hedge funds are highly flexible in their investment options thanks to their ability to utilise financial instruments that are generally beyond the reach of normal unit trusts. This flexibility gives hedge funds the unique ability to consider and manage risk differently.

Flexible Mandates

The use of pair trades is a tool that is available to hedge fund managers, but not long-only unit trust managers. Essentially, managers take advantage of valuation discrepancies that emerge within sectors or industries. The hedge fund manager purchases the share where the expected return is relatively more attractive, and simultaneously short sells a share where the expected return is less attractive. Initiating a pair trade in this manner eliminates overall market risk because the fund will have no net market exposure. Where valuation metrics converge, the manager “sells the long” and “buys back the short,” generating a profit from the convergence in prices. These trades often emerge within a specific sector, where correlations are high.

Pair Trades

Short Selling

If a long-only unit trust manager does not like a share in his investable universe, the best the fund manager can do is not to own that company. More often than not, benchmark cognisant long-only managers will declare victory for being “underweight” an underperforming company, despite still losing money for investors when the share price declines. Hedge fund managers can take advantage of falling share prices through short selling, if used judiciously. By implication, hedge funds can benefit when markets are falling, while long-only unit trusts cannot.

Hedge funds typically employ a wide range of investment strategies and asset classes, allowing for effective diversification. By investing in various markets and instruments, hedge funds aim to reduce risk and enhance overall portfolio performance.

Diversification:

Hedge Funds can provide low correlation relative to the overall market and other traditional investment strategies.

Low Correlation:

Potential for Higher Returns:

Hedge funds have the ability to generate uncorrelated returns for investors. Their flexible investment strategies, including long and short positions, leverage, and derivatives, can capitalise on market opportunities and and are not highly dependent on a rising market to generate returns for investors.

Downside Protection:

Hedge funds can protect investor capital by not participating fully in market drawdowns.

Reduced Volatility:

The unique attributes of hedge funds allow them to implement protection against falling markets, reduce market or sector exposure, and offer another point of return generation. This means they have the ability to help reduce volatility and drawdowns in an investor’s overall portfolio.

Access to Different Return Drivers:

Hedge funds offer access to a wide range of additional investment opportunities that may not be readily available through traditional investments, providing investors with potential additional sources of returns.

Our most conservative fund, the Pure Hedge Fund, and the more aggressive fund, the High Growth Fund, are available as daily dealing Retail Funds or monthly dealing Qualified Investor Funds.

The Peregrine Capital suite of hedge funds offers investors a variety of investment strategies based on their risk profile. Our investment ideas are uniformly expressed in our funds in varying proportions, depending on the fund’s risk profile. Because we invest large sums of our personal savings into these funds, our interests are fully aligned with those of our clients. All our South African hedge funds are FSCA-regulated.

Peregrine Capital is the oldest hedge fund manager in South Africa, with over two successful decades in the industry. We have been there from the beginning, helping protect and grow our clients' wealth.

We have built an exceptional team of investment professionals who are solely focused on refining our investment process each day, to deliver superior risk-adjusted returns for our clients. Our process is built on the foundations of honesty, integrity, and an unerring pursuit of the truth so investment decisions are based on facts rather than feelings.

Learn more about our Pure Hedge Fund:

Pure Hedge Fund

The Peregrine Capital Pure Hedge QI Hedge Fund is our market neutral hedge fund in which net equity exposure averages 15-20%. This is our Multi Asset - Low Equity solution with similar risk characteristics to the average stable fund.

Since its inception in July 1998, The Pure Hedge Fund has never experienced a negative year and has grown an initial investment made at inception more than 100X*.

Learn more about our High Growth Fund:

R1m invested at inception in February 2000 is worth more than R100m today**.

The Peregrine Capital High Growth QI Hedge Fund is a multi-asset hedge fund in which the net equity exposure averages around 60-75%. This is our Multi Asset - High Equity solution with similar risk characteristics to the average balanced fund.

SA’s first fund to return

100x initial investment

High Growth Fund

Allocating a portion of one’s wealth to hedge fund investments can complement a well-diversified portfolio by lowering the overall volatility, whilst improving the return profile.

Please consult your Financial Adviser to determine if hedge funds are suitable for your financial goals.

For additional information, please contact us using ask@peregrine.co.za

Name | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 5 years | Latest 15 years |

|---|---|---|---|---|---|---|

High Growth Fund | Feb-00 | 53.01% (2004) | -11.98% (2008) | 14.67% | 15.03% | 17.07% |

FTSE/JSE Capped Swix All Share Index | Feb-00 | 47.25% (2005) | -23.23% (2008) | 43.43% | 18.41% | 11.27% |

ASISA South Africa MA High Equity | Feb-00 | 27.49% (2004) | -8.24% (2008) | 18.77% | 12.69% | 9.36% |

Pure Hedge Fund | Jul-1998 | 67.90% (1999) | 1.61% (2008) | 10.64% | 11.64% | 12.48% |

Inflation (CPI) | Jul-1998 | 12.97% (2002) | 0.21% (2008) | 3.49% | 4.95% | 5.03% |

ASISA South Africa MA Low Equity | Jul-1998 | 40.59% (1999) | -10.69% (2008) | 15.51% | 10.62% | 8.45% |

Important Information

*Refers to the Peregrine Capital Pure Hedge QI Hedge Fund. Pure Hedge Fund annualised return: 18.60% | SA Multi Asset - Low Equity Category annualised return: 9.96% | CPI annualised return: 5.40%, all since inception (July 1998). R1m invested at inception is worth more than R108.9m today, SA Multi Asset - Low Equity Category: R13.6m, CPI: R4.2m.

**100X refers to the Peregrine Capital High Growth QI Hedge Fund. R1m invested at inception is worth more than R205.1m today, SA Multi Asset - High Equity Category: R14.3m, FTSE/JSE Capped SWIX: R24.7m. High Growth Fund annualised return: 22.80% | SA Multi Asset - High Equity Category annualised return: 10.82% | FTSE/JSE Capped SWIX annualised return: 13.17%, all since inception (February 2000). Date to 31 December 2025 | Source: Peregrine Capital, Morningstar, Bloomberg.

All information and opinions provided are of a general nature and are not intended to address the circumstances of any particular individual or entity. As a result thereof, there may be limitations as to the appropriateness of any information given. It is therefore recommended that the reader first obtain the appropriate legal, tax and financial advice, in order to make a decision that would suit the risk profile of the reader prior to acting upon any information. The information in this publication is provided in good faith and has been derived from sources believed to be reliable and accurate. No representation or warranty is made in relation to the accuracy or completeness of the information and opinions. No responsibility or liability is accepted by PCCI, Peregrine Capital, the portfolios and/or the directors, employees or agents of Peregrine Capital, PCCI or the portfolios, for any loss arising from the use of this publication or its contents. This publication contains information that is confidential and proprietary to Peregrine Capital and neither the publication, the information nor any opinion in it may be reproduced or distributed. Additional information, such as fund fact sheets and application forms, is available on the Peregrine Capital website at www.peregrine.co.za.

Pure Hedge Fund

Allocating a portion of one’s wealth to hedge fund investments can complement a well-diversified portfolio by lowering the overall volatility, whilst improving the return profile.

Please consult your Financial Adviser to determine if hedge funds are suitable for your financial goals.

For additional information, please contact us using ask@peregrine.co.za

R1m invested at inception in February 2000 is worth more than R100m today**.

The Peregrine Capital High Growth QI Hedge Fund is a multi-asset hedge fund in which the net equity exposure averages around 60-75%. This is our Multi Asset - High Equity solution with similar risk characteristics to the average balanced fund.

Learn more about our High Growth Fund:

SA’s first fund to return 100x initial investment

High Growth Fund

The Peregrine Capital Pure Hedge QI Hedge Fund is our market neutral hedge fund in which net equity exposure averages 15-20%. This is our Multi Asset - Low Equity solution with similar risk characteristics to the average stable fund.

Since its inception in July 1998, The Pure Hedge Fund has never experienced a negative year and has grown an initial investment made at inception more than 100X*.

Learn more about our Pure Hedge Fund:

A quant fund is an investment fund that selects securities by utilising the capabilities of advanced quantitative analysis. In quant funds, managers build customized models using software programs to determine investments for the fund.

Multi strategy hedge funds typically invest across listed asset classes, being equities,

fixed income, property, commodities and currencies. Mandates are typically flexible,

and risk varies depending on the strategies employed by the hedge fund manager.

Market neutral hedge funds are typically focused on the equity market but maintain very low levels of market exposure. As such, the correlation of these funds with equity markets is typically quite low.

Equity long/short hedge funds are focused on the equity market and seek to generate returns by using both long and short strategies within that market.

Investors often talk about hedge funds as if they are homogenous, but they are not. As is the case in the long-only unit trust world, hedge fund strategies can specialise in specific asset classes like equities or fixed income and specific strategies like long/short, short-only or macro. Hedge funds generally tend to be more unconstrained in terms of the geography they invest in. As a result, some hedge funds may be higher or lower risk by virtue of these differences in strategy, approach, and investment philosophy.

Our most conservative fund, the Pure Hedge Fund, and the more aggressive fund, the High Growth Fund, are available as daily dealing Retail Funds or monthly dealing Qualified Investor Funds.

Funds for all Risk Profiles video:

The Peregrine Capital suite of hedge funds offers investors a variety of investment strategies based on their risk profile. Our investment ideas are uniformly expressed in our funds in varying proportions, depending on the fund’s risk profile. Because we invest large sums of our personal savings into these funds, our interests are fully aligned with those of our clients. All our South African hedge funds are FSCA-regulated.

Peregrine Capital is the oldest hedge fund manager in South Africa, with over two successful decades in the industry. We have been there from the beginning, helping protect and grow our clients' wealth.

We have built an exceptional team of investment professionals who are solely focused on refining our investment process each day, to deliver superior risk-adjusted returns for our clients. Our process is built on the foundations of honesty, integrity, and an unerring pursuit of the truth so investment decisions are based on facts rather than feelings.

Unlike long-only unit trusts, most hedge funds do not subscribe to the concept of benchmarking and relative return. This means that hedge fund managers typically focus on absolute risk and return metrics rather than the outperformance or underperformance of a specific benchmark. The performance of the JSE All Share Index over the past five years highlights just how dangerous the concept of benchmarking can be for investors. Marginally outperforming the index has not generated strong absolute returns for investors. As a consequence of not being forced to track a benchmark, hedge funds don’t have the incentive to own shares in companies purely because they are part of an index.

Absolute Return Focus

Hedge funds mandates are typically constructed to give the fund manager greater discretion to pursue investments across asset classes and geographies, using a wide variety of tools. This allows the fund manager to maximise returns and manage risk. Flexible mandates also enable hedge fund managers to take advantage of special situations that arise in the bond and equity markets, where unit trust managers may be constrained where such situations occur. Hedge funds are highly flexible in their investment options thanks to their ability to utilise financial instruments that are generally beyond the reach of normal unit trusts. This flexibility gives hedge funds the unique ability to consider and manage risk differently.

Flexible Mandates

Hedge funds can apply true bottom-up fundamental research and only invest in companies they believe offer the best return potential and fundamentals.

The use of pair trades is a tool that is available to hedge fund managers, but not long-only unit trust managers. Essentially, managers take advantage of valuation discrepancies that emerge within sectors or industries. The hedge fund manager purchases the share where the expected return is relatively more attractive, and simultaneously short sells a share where the expected return is less attractive. Initiating a pair trade in this manner eliminates overall market risk because the fund will have no net market exposure. Where valuation metrics converge, the manager “sells the long” and “buys back the short,” generating a profit from the convergence in prices. These trades often emerge within a specific sector, where correlations are high.

Pair Trades

Short Selling

If a long-only unit trust manager does not like a share in his investable universe, the best the fund manager can do is not to own that company. More often than not, benchmark cognisant long-only managers will declare victory for being “underweight” an underperforming company, despite still losing money for investors when the share price declines. Hedge fund managers can take advantage of falling share prices through short selling, if used judiciously. By implication, hedge funds can benefit when markets are falling, while long-only unit trusts cannot.

Hedge Funds can provide low correlation relative to the overall market and other traditional investment strategies.

Low Correlation:

Access to Different Return Drivers:

Hedge funds offer access to a wide range of additional investment opportunities that may not be readily available through traditional investments, providing investors with potential additional sources of returns.

Reduced Volatility:

The unique attributes of hedge funds allow them to implement protection against falling markets, reduce market or sector exposure, and offer another point of return generation. This means they have the ability to help reduce volatility and drawdowns in an investor’s overall portfolio.

Downside Protection:

Hedge funds can protect investor capital by not participating fully in market drawdowns.

Hedge funds typically employ a wide range of investment strategies and asset classes, allowing for effective diversification. By investing in various markets and instruments, hedge funds aim to reduce risk and enhance overall portfolio performance.

Diversification:

Potential for Higher Returns:

Hedge funds have the ability to generate uncorrelated returns for investors. Their flexible investment strategies, including long and short positions, leverage, and derivatives, can capitalise on market opportunities and and are not highly dependent on a rising market to generate returns for investors.

Similarities & Differences

Like traditional funds, hedge funds are a category of unit trusts, governed by the Financial Services Conduct Authority (FSCA).

Hedge fund managers can invest in the same asset classes available to traditional unit trust managers.

Unlike unit trusts, hedge funds can extract positive performance in both upward and downward-trending market conditions. This is thanks to a tool in the toolbox of hedge funds called “short selling,” whereby one profits from a decline in share prices.

Most unit trusts strive to outperform a benchmark, whereas hedge funds focus on generating absolute returns and delivering positive returns to clients irrespective of how the broader market performs.

Hedge fund managers have more investment opportunities and tools to generate returns and manage risk.

A hedge fund is similar to a unit trust fund but has broader discretion in terms of the types of investments the fund manager can pursue, and a wider set of tools that can be employed to generate returns and manage risk.

At Peregrine Capital, we strive to achieve superior risk-adjusted returns for our clients by drawing on a well-established toolkit; refined over many years through our ever evolving and rigorous investment process. If the available toolkit is used appropriately by an astute fund manager, an effective hedge fund strategy can enhance investor returns, while also managing downside risks.

*Refers to the Peregrine Capital Pure Hedge QI Hedge Fund. Pure Hedge Fund annualised return: 18.60% | SA Multi Asset - Low Equity Category annualised return: 9.96% | CPI annualised return: 5.40%, all since inception (July 1998). R1m invested at inception is worth more than R108.9m today, SA Multi Asset - Low Equity Category: R13.6m, CPI: R4.2m.

**100X refers to the Peregrine Capital High Growth QI Hedge Fund. R1m invested at inception is worth more than R205.1m today, SA Multi Asset - High Equity Category: R14.3m, FTSE/JSE Capped SWIX: R24.7m. High Growth Fund annualised return: 22.80% | SA Multi Asset - High Equity Category annualised return: 10.82% | FTSE/JSE Capped SWIX annualised return: 13.17%, all since inception (February 2000). Date to 31 December 2025 | Source: Peregrine Capital, Morningstar, Bloomberg.

Name | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 5 years | Latest 10 years |

|---|---|---|---|---|---|---|

High Growth Fund | Feb-00 | 53.01% (2004) | -11.98% (2008) | 15.00% | 11.98% | 14.64% |

FTSE/JSE Capped Swix All Share Index | Feb-00 | 47.25% (2005) | -23.23% (2008) | 10.87% | 6.91% | 8.23% |

ASISA South Africa MA High Equity | Feb-00 | 27.49% (2004) | -8.24% (2008) | 16.51% | 7.61% | 7.81% |

Pure Hedge Fund | Jul-1998 | 67.90% (1999) | 1.61% (2008) | 14.18% | 10.86% | 11.79% |

Inflation (CPI) | Jul-1998 | 12.97% (2002) | 0.21% (2008) | 6.00% | 4.89% | 5.16% |

ASISA South Africa MA Low Equity | Jul-1998 | 40.59% (1999) | -10.69% (2008) | 14.49% | 7.19% | 7.25% |

All information and opinions provided are of a general nature and are not intended to address the circumstances of any particular individual or entity. As a result thereof, there may be limitations as to the appropriateness of any information given. It is therefore recommended that the reader first obtain the appropriate legal, tax and financial advice, in order to make a decision that would suit the risk profile of the reader prior to acting upon any information. The information in this publication is provided in good faith and has been derived from sources believed to be reliable and accurate. No representation or warranty is made in relation to the accuracy or completeness of the information and opinions. No responsibility or liability is accepted by PCCI, Peregrine Capital, the portfolios and/or the directors, employees or agents of Peregrine Capital, PCCI or the portfolios, for any loss arising from the use of this publication or its contents. This publication contains information that is confidential and proprietary to Peregrine Capital and neither the publication, the information nor any opinion in it may be reproduced or distributed. Additional information, such as fund fact sheets and application forms, is available on the Peregrine Capital website at www.peregrine.co.za.

Important Information