Investor Letter

In April 2024, we launched the Peregrine Capital Vision Fund (a USD-denominated fund). We had some interest from investors in a fund that is more focused on global opportunities, whilst maintaining a different volatility level from our existing funds. The fund aims to take concentrated positions in our best global ideas. The major difference between Vision and High Growth is the significantly higher volatility investors should expect in this fund. For High Growth and Pure Hedge, we are very focused on delivering consistent returns while limiting major drawdowns. The Vision Fund was created for investors with a higher risk appetite, and as such, much greater drawdowns can be expected in volatile times.

The trade-off is that higher volatility parameters give us more leeway to pursue high potential return opportunities. As such, potential return could be higher if we deliver on that. Comparing Vision vs High Growth since 1 April 2024, you will notice that the biggest down month in Vision was -5.04% vs only -0.95% for High Growth. At the same time, the largest up month was 9.64% for Vision vs 4.19% for High Growth. We currently have a monthly dealing version of the Vision Fund available to investors, with a daily dealing fund expected to become available within the next 3 months. The Vision Fund also had a good 2025, delivering a 28.96% return for investors. Reach out to us if you would like more details.

The Peregrine Capital High Growth and Pure Hedge funds delivered 14.7% and 10.6%, respectively, for the year.

During the year, we crossed the 200x money* threshold for the High Growth Fund. We believe that real wealth is created by consistently compounding returns over the long run, while avoiding major drawdowns in capital.

This is exactly what we aim to deliver, and we are pleased to have done so again in 2025.

Watch Jacques Conradie and David Fraser talk about the 2025 funds’ performance:

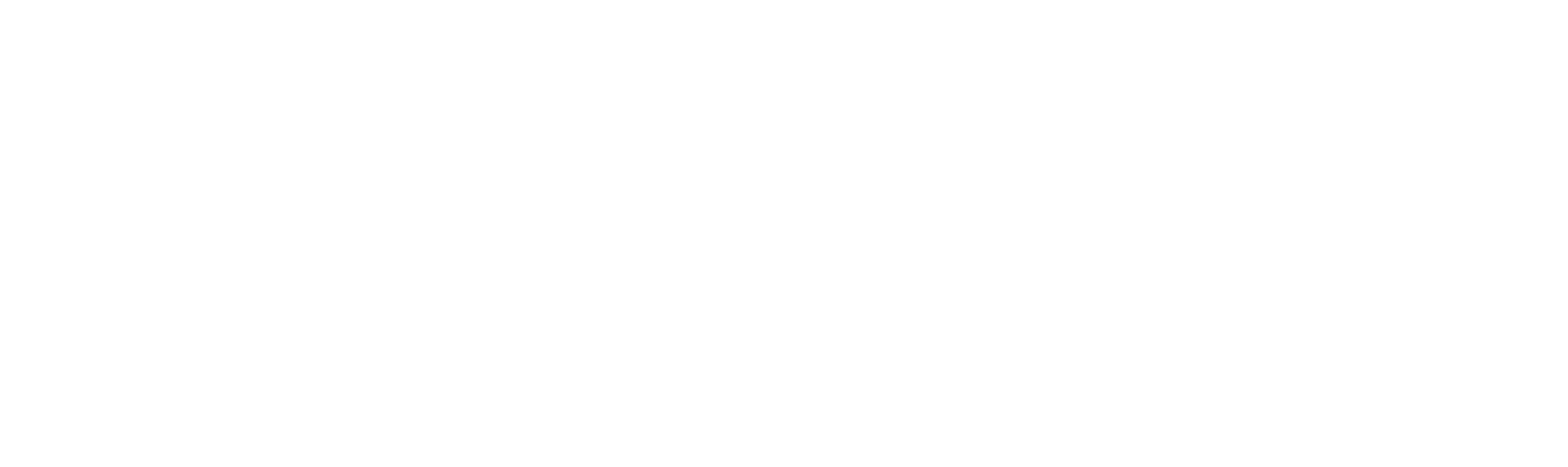

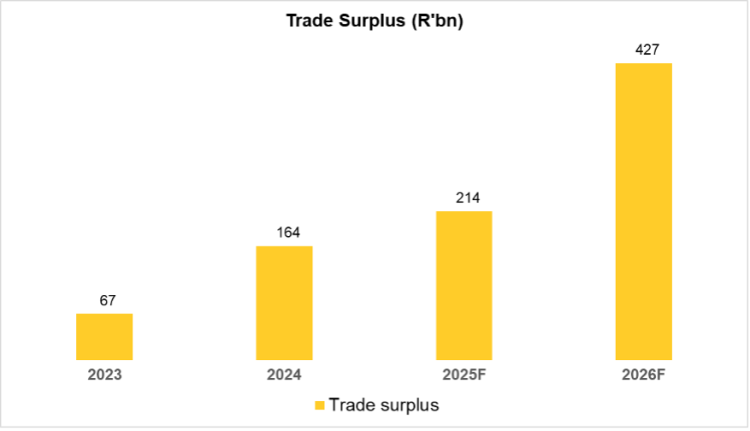

Source: SARS, Bloomberg and Peregrine Capital estimates

Source: Bloomberg, and Peregrine Capital estimates.

Sometimes you get dealt lucky cards and end up with a really good hand through no skill of your own, and this has happened to South Africa in the past 18 months.

Three years ago, these models surprised the world by speaking in human language and answering some fairly basic questions. Now they are competing with the world’s smartest humans in some select fields.

2025 was likely the most impactful year with regard to changing geopolitics that the world has seen since the fall of the Berlin Wall in 1989.

Under President Trump, the US has changed its role from defender of the Post-Cold War era, to being much more focused on acting in the narrow best interest of the USA.

What were the key indicators:

The US changed its trade approach in April 2025, which significantly shook markets at the time. Under Trump, it has framed trade as a more adversarial relationship rather than mutually beneficial.

Trump signed an executive order on 20 January 2025 for the US to withdraw from the World Health Organisation. The US is withdrawing from more than 60 international organisations, including more than 30 affiliated with the United Nations.

The US capture of the president of Venezuela and attempt to implement a change of government. This is very significant as the apparent reason for the capture is purely that he didn’t want to work with the US and was allied with Russia and China.

Trump’s stated desire to increase annual US war spending from $1trn to $1.5trn, a spectacular $500bn increase.

Significant changes to the US stance on things like immigration and free movement of people between countries.

2025 was likely the most impactful year with regard to changing geopolitics that the world has seen since the fall of the Berlin Wall in 1989. If we look back in a few years, 2025 might be the year we remember as the one when the Post-Cold War Era that we have been living in since 1990, officially ended.

So, what has driven these seismic shifts in 2025?

The major global developments in 2025 were in geopolitics and Artificial Intelligence. We will cover each of these in turn.

Store of

Value Assets

Geopolitics

South Africa

Artificial Intelligence

What is driving this:

We see the underlying driver of this change in posture as the great power struggle between the USA and China. This conflict has been building steadily as China has grown in economic and military strength, rivalling the US over the past 20 years. The US has realised over the past 5 years that its era of uncontested global hegemony is coming to an end and has decided to change its approach to prepare for what increasingly looks like the Cold War period.

It seems likely to us that this great-power conflict could well define the next 20 years and will be a cause of significant events and disruptions. We have been closely monitoring these changes over the past several years. It will have many unpredictable and unprecedented effects on the world. The main investment theme linked to this is the rise in importance of “store of value” assets, which we will cover in detail later in this letter.

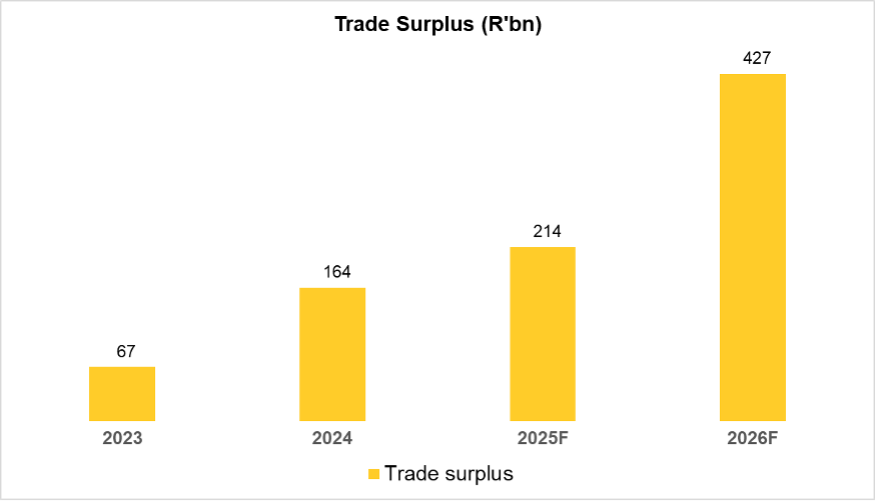

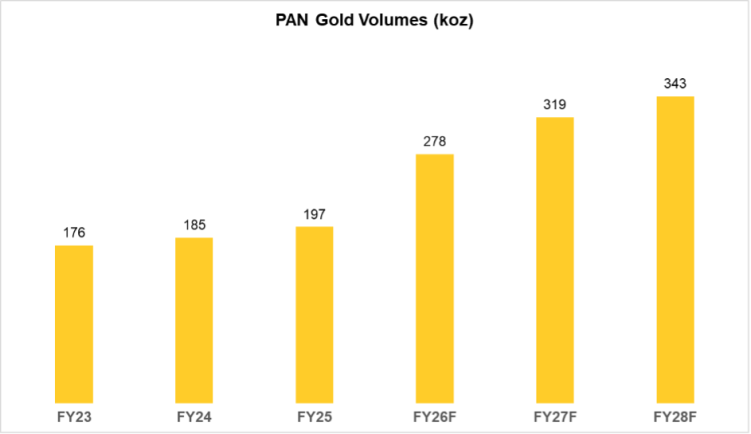

Source: https://www.panafricanresources.com/ and Peregrine Capital forecasts

These positions were meaningful contributors to returns in 2025. During 2026, we will closely monitor the trends that have resulted in the increased demand for store of value assets. The underlying reasons to own them seem as strong or stronger than ever before. This must be contrasted with the already strong performance in 2025 in some of these assets. We will aim to strike the right balance by closely following global events. A key consideration for investors will be how much store of value exposure they want in their overall portfolios.

PAN is a JSE-listed gold miner with operations in South Africa and Australia. They are a low-cost producer, but what we like most about PAN is their ability to grow gold ounces produced through organic projects. The projects are unbelievably attractive at current gold prices, and PAN should provide great returns to investors, driven by the high gold price, but also deliver stock specific outperformance through volume growth.

This has come after a 30-year period in which very few investors globally had meaningful exposure to store of value assets in their portfolios. The change in trend has been extremely rapid, with gold rising 65% during 2025 and silver rising 147%. These are massive moves for assets with large market caps.

What are the key contenders for store of value assets

Gold

Silver

Other precious metals (platinum, palladium for example)

Other base metals (copper, nickel and the like

Other assets with limited supply (cryptocurrencies like Bitcoin)

High quality equities

Land / property

Most of you will know that we have very rarely invested in commodities during the past 27 years, doing so only in cases when exceptional opportunities emerged such as Thungela Coal from 2021 to 2023.

As the case became stronger to own store of value assets during 2025, we increased our exposure to gold miners, specifically Pan African Resources while also adding some PGM (Platinum Group Metals) miners to the portfolio.

Some of the reasons that cash has become less attractive and store of-value assets more so:

The deterioration of cash as a store of wealth became clear after COVID when governments printed excessive amounts of money while keeping interest rates close to zero. This caused inflation globally that peaked close to 10%, massively devaluing anyone sitting on cash.

Governments were expected to reduce budget deficits post-COVID, and especially the US, where Trump and Elon promised the DOGE (Department of Government Efficiency) effort post-election. DOGE hardly cut any government expenditure, and governments around the world decided it was better to give people more handouts and spend more, leaving the deficit problem for the future.

Talks about the Western countries seizing Russia’s foreign reserves due to the Ukraine war. This makes it clear to any country that owning FIAT (the paper currency of another country) puts you at greater risk of your assets being seized. It is much better to own physical gold in your own vaults, which one’s adversaries can’t take.

The increased conflicts globally (Russia / Ukraine, the Middle East, and the US intervention in Venezuela) have made people more nervous about how the future plays out. It is best to own assets that retain their value regardless of what happens in the broader economy.

As mentioned earlier, we believe the thematic trade that has benefitted most from global events during 2025 is “store of value” assets. We define store of value assets as follows:

“Assets with limited supply that will hold their value in different economic environments, and that can be exchanged for the same or more goods and services in the future.”

During the past 30 years, owning cash in USD, Euros, Pounds or even Rands did a reasonable job of protecting you against inflation (if you include the interest earned on the money).

However, the case for owning cash as your major store of value has deteriorated meaningfully over the last 5 years, and we believe a tipping point has been reached in 2025.

We should not underestimate just how unbelievable this is. Three years ago, these models surprised the world by speaking in human language and answering some fairly basic questions. Now they are competing with the world’s smartest humans in some select fields.

The rate of improvement is not uniform, as the models can still make some mistakes on rudimentary questions. However, it is now clear that the biggest impact over the next few years is likely to be in coding. The models are improving rapidly, with capabilities changing monthly. The phrase “vibe coding” has emerged for the ability to just tell the AI what you want, and it will build an entire piece of software for you just from the prompt. Over the next year or two, we will likely see an unbelievable proliferation of software in the world, as we are quite close to where anyone can create a custom piece of software. How unbelievable is that?!

The one thing that has weighed on our minds is the massive increase in capital expenditure that we have seen from all the major technology companies in the West. While AI has improved rapidly, the amount of capital spent on data centres for AI is increasing just as fast, if not more so. This came to a head when the market figured out that OpenAI had made an estimated $1.4trn of future compute commitments, on a 2025 revenue estimate of only $15bn. So, the spend commitment is about 100x what their total revenue was in the last year.

We are big believers that AI will change the world as we know it over the next 10 or 20 years. However, the spending on AI needs to match the benefits that AI will bring to companies, their revenue, and eventual earnings. We are worried that if spend on AI continues to grow at such high rates, it might run too far ahead of the benefits in the short run. Faster and more aggressive spending shift the short-term benefit of AI away from the large tech companies that use AI and transfers much of the short-term profits to semiconductor companies.

The capital expenditure binge we observed in the West has not extended to the Chinese market. This is mainly because US chip controls have prevented Chinese technology companies from acquiring leading-edge chips designed in the US. Despite these punitive restrictions, Chinese development in the AI space has not slowed. Our recent visit to China confirmed both the ambition of those entrepreneurs, and the incredible progress in that market. With self-driving cars, drones delivering lunch orders, and robots of many forms out in the wild. The AI race is on!

Our major new technology position during the year was TSMC, which we touched on in our semi-annual investor letter last year. Since establishing the position in April 2025, trends have favoured TSMC even further. They are the only scale producer of leading-edge chips for data centres and continue to be Apple’s primary supplier of chips for iPhones and Macs. In addition to manufacturing chips for Nvidia, TSMC now counts Google, Amazon, Microsoft, Meta, and AMD as significant customers, all of which are trying to displace Nvidia in chip design. The TSMC position has performed very well and was a top 5 contributor to returns in 2025. We believe the outlook remains exceptional for TSMC, with the potential to grow earnings at 30% per annum for the next 4 years.

We have been writing about Artificial Intelligence (“AI”) in our letters every year since 2022 when ChatGPT was first launched. The view that AI will be the defining technological trend of our lifetimes has become much more widely accepted during the past year.

Foundation models have continued their rapid rate of improvement during 2025. The major innovation was “thinking models”, which became much more commonly used and provided meaningfully improved answers.

It has also become clear that the models are improving very rapidly in fields where answers can be exactly verified and, therefore, can be trained to keep getting better and better. We have seen this clearly with OpenAI’s models scoring high enough to win gold medals at the International Maths Olympiad and the International Olympiad in Informatics. This means that in maths and programming, these models are now approaching the performance of the world’s smartest humans.

All in all, we have close to a best-case big picture global backdrop for South Africa.

Naturally, we still have specific internal issues that negatively affect South Africa:

The ANC still wants to move forward with NHI and expropriation of private property without compensation, which stunts investor confidence, and the expansion of welfare spending we can ill afford.

Real issues are emerging in local government after years of neglect, with water infrastructure being the primary near-term concern.

Online gambling has become a massive issue in South Africa. Estimates are that consumers now lose as much as R60bn per annum on online gambling, money that could otherwise have been spent on food and other necessities. There is a giant addiction problem that needs to be addressed, as highlighted by many CEOs of large South African companies during recent results.

Our foreign policy stance continues to play an outsized role in our inability to attract much-needed foreign direct investment, particularly from the USA.

However, there are reasons for optimism. It has now been almost 2 years since the last major widespread loadshedding in South Africa. The massive rollout of private-sector solar, together with improved power delivery from Eskom, has made loadshedding a thing of the past.

The Government of National Unity is still standing after 18 months, despite a huge conflict last year when the ANC tried to increase VAT in the budget, and the DA resisted. This contestation of ideas is very positive for South Africa and has led to the implementation of much more moderate policies. Polling data ahead of the upcoming local government elections offers hope for the revival of the prospects of major metropolitans, which are key enablers of economic growth.

The surge in gold and platinum prices has also had a massive impact on South African markets. As a commodity export economy, more than 25% of the JSE index is currently made up of gold and platinum miners. These sectors were up spectacularly in 2025; several gold and platinum shares increased by 200%+ during the year. This drove the JSE to be one of the best-performing markets globally during 2025, with the index up more than 40% for the year. This was the best year for the JSE since 2005!

With the trade surplus driving additional demand for Rands, our currency has strengthened from R18.89 to R16.57 to the US Dollar. It is quite possible that this trend could continue in 2026.

A massive increase in tax collections and mining royalties will result from the higher commodity prices.

Lower inflation due to the stronger currency, leaves consumers with more disposable income. Lower inflation allows for interest rate cuts, further benefitting consumers and the economy.

A lower budget deficit leads to lower borrowing costs on government debt. The interest rate we pay on the 10-year government bond has fallen from above 11% at peak last year to below 8.5% now.

While this will take time to become apparent, lower government borrowing costs will substantially reduce government expenditure in the years to come, further narrowing the budget deficit.

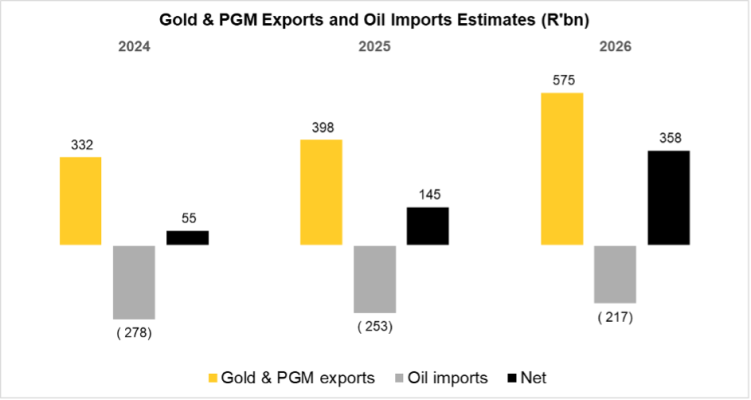

The attached graph shows that gold & PGM exports grew from R332bn to R398bn in 2025. We provide indicative numbers for 2026 based on current gold, PGM, and oil prices. The picture looks rosy for South Africa indeed!

What benefits does this rally deliver to our economy?

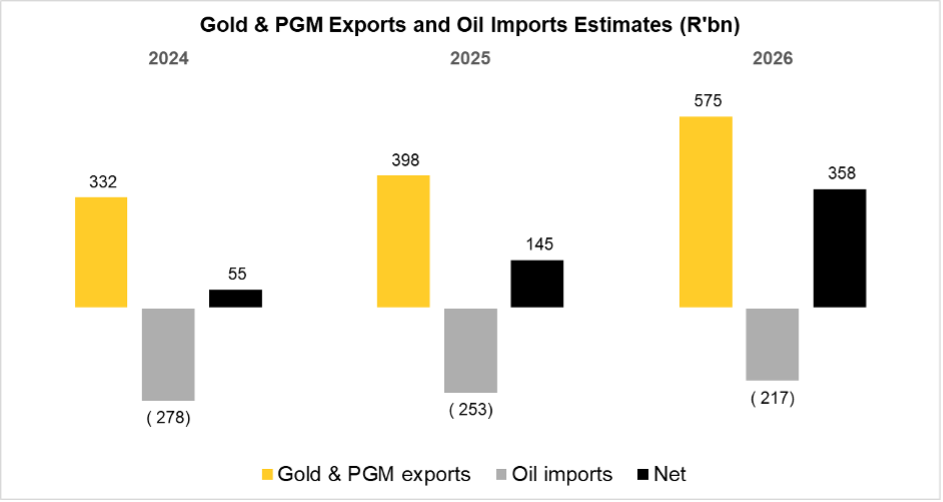

We are currently running a massive trade surplus. The prices of our key exports (gold and platinum) are up significantly. What is our biggest import? Oil and petroleum-related products. Trump has made it clear he wants to keep oil prices low by flooding the market with supply, so our imports are likely to stay low. This has led to a trade surplus of more than R200bn for 2025, which is likely to be substantially bigger in 2026.

We have left the South African macro section for later in the letter, as it is so meaningfully impacted by what we have covered before.

South Africa is one of the countries that benefit most from the emerging store of value thesis. Our two biggest exports are gold and platinum-group metals (PGMs)!! How lucky is that with gold up 65% during 2025 and platinum up 125%! Investors want these assets, and South Africa produces around 80% of the world’s platinum group metals! There is no other place to get them. Sometimes you get dealt lucky cards and end up with a really good hand through no skill of your own, and this has happened to South Africa in the past 18 months.

It has been an extremely exciting time to manage money, with so many changes occurring worldwide and in SA.

We would summarise the key big picture trends as AI, store of value assets, and the South African recovery.

As South Africans, we are probably most excited about the potential improvements we see in SA. We know domestic South African businesses very well and are finding great opportunities to play the recovery story. We hope the government takes advantage of the lucky hand we have been dealt and doesn’t squander this amazing opportunity for economic revival that we have been given.

On the global front, while there are real geopolitical concerns, we are living through what will likely be the most exciting time for technological development in human history. Productivity improvements from AI across the global economy could be immense over the next 5 years, and over long-term horizons, the impact of billions of humanoid robots automating many tasks will be just as incredible. What a time to be alive and to be an investor.

Our goal, as always, is to deliver consistent returns for investors without being benchmarked to any specific index or market. We believe that long-term wealth is created by compounding your assets year in, year out, in good markets and bad. It comes from avoiding major drawdowns on your capital, capturing the upside in good years, and avoiding major losses in bad years. This approach has worked well for our investors and us for 27 years, and we believe it will continue to deliver going forward. We look forward to navigating these most interesting of times.

Given the more positive economic backdrop for South Africa and still moderate valuations, we increased our SA exposure during the last quarter of 2025. We added exposure to banks, retailers, and food producers, among others. The macroeconomic tailwinds haven’t quite translated into meaningful on-the-ground improvement in company results, but we think there is a very good chance that will start to happen during 2026.

It has been an extremely exciting time to manage money, with so many changes occurring worldwide and in SA. We would summarise the key big picture trends as AI, store of value assets, and the South African recovery. We own great companies behind each of these themes and are currently in the fortunate position where good ideas must fight to get into the portfolio.

With Thanks

Please contact us via ask@peregrine.co.za if you have any questions or comments.

Fund Name | Inception date | Highest annual return | Lowest rolling annual return | Latest 1 year |

|---|---|---|---|---|

Vision Fund | Apr-2024 | 28.96% | 9.57% | 28.96% |

HFRX Equity Hedge Index | Apr-2024 | 10.06% | -0.8% | 10.06% |

Fund Name | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 5 years | Latest 15 years |

|---|---|---|---|---|---|---|

Pure Hedge Fund | Jul-1998 | 67.90% (1999) | 1.61% (2008) | 10.64% | 11.64% | 12.48% |

Inflation (CPI) | Jul-1998 | 12.97% (2002) | 0.21% (2008) | 3.49% | 4.95% | 5.40% |

ASISA South Africa MA Low Equity | Jul-1998 | 40.59% (1999) | -10.69% (2008) | 15.51% | 10.62% | 9.96% |

Fund Name | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 5 years | Latest 15 years |

|---|---|---|---|---|---|---|

High Growth Fund | Feb-00 | 53.01% (2004) | -11.98% (2008) | 14.67% | 15.03% | 17.07% |

ASISA South Africa MA High Equity | Feb-00 | 27.49% (2004) | -8.24% (2008) | 18.77% | 12.69% | 9.36% |

Important Information

The calculation of all net returns from 1 February 2000 until 30 November 2016 relates to the Peregrine High Growth Fund, prior to its inclusion under CISCA. Thereafter, the data relates to the Peregrine Capital High Growth QI Hedge Fund (“High Growth Fund”). The calculation of all net returns from 1 July 1998 until 30 November 2016 relates to the Peregrine Pure Hedge Fund, prior to its inclusion under CISCA. Thereafter, the data relates to the Peregrine Capital Pure Hedge QI Hedge Fund (“Pure Hedge Fund”).

Data to 31 December 2025 | Source: Peregrine Capital, Morningstar, Bloomberg.

Investor Letter

In April 2024, we launched the Peregrine Capital Vision Fund (a USD-denominated fund). We had some interest from investors in a fund that is more focused on global opportunities, whilst maintaining a different volatility level from our existing funds. The fund aims to take concentrated positions in our best global ideas. The major difference between Vision and High Growth is the significantly higher volatility investors should expect in this fund. For High Growth and Pure Hedge, we are very focused on delivering consistent returns while limiting major drawdowns. The Vision Fund was created for investors with a higher risk appetite, and as such, much greater drawdowns can be expected in volatile times.

The trade-off is that higher volatility parameters give us more leeway to pursue high potential return opportunities. As such, potential return could be higher if we deliver on that. Comparing Vision vs High Growth since 1 April 2024, you will notice that the biggest down month in Vision was -5.04% vs only -0.95% for High Growth. At the same time, the largest up month was 9.64% for Vision vs 4.19% for High Growth. We currently have a monthly dealing version of the Vision Fund available to investors, with a daily dealing fund expected to become available within the next 3 months. The Vision Fund also had a good 2025, delivering a 28.96% return for investors. Reach out to us if you would like more details.

This is exactly what we aim to deliver, and we are pleased to have done so again in 2025.

The Peregrine Capital High Growth and Pure Hedge funds delivered 14.7% and 10.6%, respectively, for the year.

During the year, we crossed the 200x money* threshold for the High Growth Fund. We believe that real wealth is created by consistently compounding returns over the long run, while avoiding major drawdowns in capital.

Watch Jacques Conradie and David Fraser talk about the 2025 funds’ performance:

All in all, we have close to a best-case big picture global backdrop for South Africa.

Naturally, we still have specific internal issues that negatively affect South Africa:

The ANC still wants to move forward with NHI and expropriation of private property without compensation, which stunts investor confidence, and the expansion of welfare spending we can ill afford.

Real issues are emerging in local government after years of neglect, with water infrastructure being the primary near-term concern.

Online gambling has become a massive issue in South Africa. Estimates are that consumers now lose as much as R60bn per annum on online gambling, money that could otherwise have been spent on food and other necessities. There is a giant addiction problem that needs to be addressed, as highlighted by many CEOs of large South African companies during recent results.

Our foreign policy stance continues to play an outsized role in our inability to attract much-needed foreign direct investment, particularly from the USA.

However, there are reasons for optimism. It has now been almost 2 years since the last major widespread loadshedding in South Africa. The massive rollout of private-sector solar, together with improved power delivery from Eskom, has made loadshedding a thing of the past.

The Government of National Unity is still standing after 18 months, despite a huge conflict last year when the ANC tried to increase VAT in the budget, and the DA resisted. This contestation of ideas is very positive for South Africa and has led to the implementation of much more moderate policies. Polling data ahead of the upcoming local government elections offers hope for the revival of the prospects of major metropolitans, which are key enablers of economic growth.

The surge in gold and platinum prices has also had a massive impact on South African markets. As a commodity export economy, more than 25% of the JSE index is currently made up of gold and platinum miners. These sectors were up spectacularly in 2025; several gold and platinum shares increased by 200%+ during the year. This drove the JSE to be one of the best-performing markets globally during 2025, with the index up more than 40% for the year. This was the best year for the JSE since 2005!

Source: SARS, Bloomberg and Peregrine Capital estimates

With the trade surplus driving additional demand for Rands, our currency has strengthened from R18.89 to R16.57 to the US Dollar. It is quite possible that this trend could continue in 2026.

A massive increase in tax collections and mining royalties will result from the higher commodity prices.

Lower inflation due to the stronger currency, leaves consumers with more disposable income. Lower inflation allows for interest rate cuts, further benefitting consumers and the economy.

A lower budget deficit leads to lower borrowing costs on government debt. The interest rate we pay on the 10-year government bond has fallen from above 11% at peak last year to below 8.5% now.

While this will take time to become apparent, lower government borrowing costs will substantially reduce government expenditure in the years to come, further narrowing the budget deficit.

The attached graph shows that gold & PGM exports grew from R332bn to R398bn in 2025. We provide indicative numbers for 2026 based on current gold, PGM, and oil prices. The picture looks rosy for South Africa indeed!

Source: Bloomberg, and Peregrine Capital estimates.

What benefits does this rally deliver to our economy?

We are currently running a massive trade surplus. The prices of our key exports (gold and platinum) are up significantly. What is our biggest import? Oil and petroleum-related products. Trump has made it clear he wants to keep oil prices low by flooding the market with supply, so our imports are likely to stay low. This has led to a trade surplus of more than R200bn for 2025, which is likely to be substantially bigger in 2026.

Sometimes you get dealt lucky cards and end up with a really good hand through no skill of your own, and this has happened to South Africa in the past 18 months.

We have left the South African macro section for later in the letter, as it is so meaningfully impacted by what we have covered before.

South Africa is one of the countries that benefit most from the emerging store of value thesis. Our two biggest exports are gold and platinum-group metals (PGMs)!! How lucky is that with gold up 65% during 2025 and platinum up 125%! Investors want these assets, and South Africa produces around 80% of the world’s platinum group metals! There is no other place to get them. Sometimes you get dealt lucky cards and end up with a really good hand through no skill of your own, and this has happened to South Africa in the past 18 months.

These positions were meaningful contributors to returns in 2025. During 2026, we will closely monitor the trends that have resulted in the increased demand for store of value assets. The underlying reasons to own them seem as strong or stronger than ever before. This must be contrasted with the already strong performance in 2025 in some of these assets. We will aim to strike the right balance by closely following global events. A key consideration for investors will be how much store of value exposure they want in their overall portfolios.

Source: https://www.panafricanresources.com/ and Peregrine Capital forecasts

PAN is a JSE-listed gold miner with operations in South Africa and Australia. They are a low-cost producer, but what we like most about PAN is their ability to grow gold ounces produced through organic projects. The projects are unbelievably attractive at current gold prices, and PAN should provide great returns to investors, driven by the high gold price, but also deliver stock specific outperformance through volume growth.

Some of the reasons that cash has become less attractive and store of-value assets more so:

The deterioration of cash as a store of wealth became clear after COVID when governments printed excessive amounts of money while keeping interest rates close to zero. This caused inflation globally that peaked close to 10%, massively devaluing anyone sitting on cash.

Governments were expected to reduce budget deficits post-COVID, and especially the US, where Trump and Elon promised the DOGE (Department of Government Efficiency) effort post-election. DOGE hardly cut any government expenditure, and governments around the world decided it was better to give people more handouts and spend more, leaving the deficit problem for the future.

Talks about the Western countries seizing Russia’s foreign reserves due to the Ukraine war. This makes it clear to any country that owning FIAT (the paper currency of another country) puts you at greater risk of your assets being seized. It is much better to own physical gold in your own vaults, which one’s adversaries can’t take.

The increased conflicts globally (Russia / Ukraine, the Middle East, and the US intervention in Venezuela) have made people more nervous about how the future plays out. It is best to own assets that retain their value regardless of what happens in the broader economy.

As mentioned earlier, we believe the thematic trade that has benefitted most from global events during 2025 is “store of value” assets. We define store of value assets as follows:

“Assets with limited supply that will hold their value in different economic environments, and that can be exchanged for the same or more goods and services in the future.”

During the past 30 years, owning cash in USD, Euros, Pounds or even Rands did a reasonable job of protecting you against inflation (if you include the interest earned on the money).

However, the case for owning cash as your major store of value has deteriorated meaningfully over the last 5 years, and we believe a tipping point has been reached in 2025.

The one thing that has weighed on our minds is the massive increase in capital expenditure that we have seen from all the major technology companies in the West. While AI has improved rapidly, the amount of capital spent on data centres for AI is increasing just as fast, if not more so. This came to a head when the market figured out that OpenAI had made an estimated $1.4trn of future compute commitments, on a 2025 revenue estimate of only $15bn. So, the spend commitment is about 100x what their total revenue was in the last year.

We are big believers that AI will change the world as we know it over the next 10 or 20 years. However, the spending on AI needs to match the benefits that AI will bring to companies, their revenue, and eventual earnings. We are worried that if spend on AI continues to grow at such high rates, it might run too far ahead of the benefits in the short run. Faster and more aggressive spending shift the short-term benefit of AI away from the large tech companies that use AI and transfers much of the short-term profits to semiconductor companies.

The capital expenditure binge we observed in the West has not extended to the Chinese market. This is mainly because US chip controls have prevented Chinese technology companies from acquiring leading-edge chips designed in the US. Despite these punitive restrictions, Chinese development in the AI space has not slowed. Our recent visit to China confirmed both the ambition of those entrepreneurs, and the incredible progress in that market. With self-driving cars, drones delivering lunch orders, and robots of many forms out in the wild. The AI race is on!

Our major new technology position during the year was TSMC, which we touched on in our semi-annual investor letter last year. Since establishing the position in April 2025, trends have favoured TSMC even further. They are the only scale producer of leading-edge chips for data centres and continue to be Apple’s primary supplier of chips for iPhones and Macs. In addition to manufacturing chips for Nvidia, TSMC now counts Google, Amazon, Microsoft, Meta, and AMD as significant customers, all of which are trying to displace Nvidia in chip design. The TSMC position has performed very well and was a top 5 contributor to returns in 2025. We believe the outlook remains exceptional for TSMC, with the potential to grow earnings at 30% per annum for the next 4 years.

We should not underestimate just how unbelievable this is. Three years ago, these models surprised the world by speaking in human language and answering some fairly basic questions. Now they are competing with the world’s smartest humans in some select fields.

The rate of improvement is not uniform, as the models can still make some mistakes on rudimentary questions. However, it is now clear that the biggest impact over the next few years is likely to be in coding. The models are improving rapidly, with capabilities changing monthly. The phrase “vibe coding” has emerged for the ability to just tell the AI what you want, and it will build an entire piece of software for you just from the prompt. Over the next year or two, we will likely see an unbelievable proliferation of software in the world, as we are quite close to where anyone can create a custom piece of software. How unbelievable is that?!

Three years ago, these models surprised the world by speaking in human language and answering some fairly basic questions. Now they are competing with the world’s smartest humans in some select fields.

We have been writing about Artificial Intelligence (“AI”) in our letters every year since 2022 when ChatGPT was first launched. The view that AI will be the defining technological trend of our lifetimes has become much more widely accepted during the past year.

Foundation models have continued their rapid rate of improvement during 2025. The major innovation was “thinking models”, which became much more commonly used and provided meaningfully improved answers.

It has also become clear that the models are improving very rapidly in fields where answers can be exactly verified and, therefore, can be trained to keep getting better and better. We have seen this clearly with OpenAI’s models scoring high enough to win gold medals at the International Maths Olympiad and the International Olympiad in Informatics. This means that in maths and programming, these models are now approaching the performance of the world’s smartest humans.

Under President Trump, the US has changed its role from defender of the Post-Cold War era, to being much more focused on acting in the narrow best interest of the USA.

What were the key indicators:

The US changed its trade approach in April 2025, which significantly shook markets at the time. Under Trump, it has framed trade as a more adversarial relationship rather than mutually beneficial.

Trump signed an executive order on 20 January 2025 for the US to withdraw from the World Health Organisation. The US is withdrawing from more than 60 international organisations, including more than 30 affiliated with the United Nations.

The US capture of the president of Venezuela and attempt to implement a change of government. This is very significant as the apparent reason for the capture is purely that he didn’t want to work with the US and was allied with Russia and China.

Trump’s stated desire to increase annual US war spending from $1trn to $1.5trn, a spectacular $500bn increase.

Significant changes to the US stance on things like immigration and free movement of people between countries.

2025 was likely the most impactful year with regard to changing geopolitics that the world has seen since the fall of the Berlin Wall in 1989.

2025 was likely the most impactful year with regard to changing geopolitics that the world has seen since the fall of the Berlin Wall in 1989. If we look back in a few years, 2025 might be the year we remember as the one when the Post-Cold War Era that we have been living in since 1990, officially ended.

So, what has driven these seismic shifts in 2025?

The major global developments in 2025 were in geopolitics and Artificial Intelligence. We will cover each of these in turn.

What is driving this:

We see the underlying driver of this change in posture as the great power struggle between the USA and China. This conflict has been building steadily as China has grown in economic and military strength, rivalling the US over the past 20 years. The US has realised over the past 5 years that its era of uncontested global hegemony is coming to an end and has decided to change its approach to prepare for what increasingly looks like the Cold War period.

It seems likely to us that this great-power conflict could well define the next 20 years and will be a cause of significant events and disruptions. We have been closely monitoring these changes over the past several years. It will have many unpredictable and unprecedented effects on the world. The main investment theme linked to this is the rise in importance of “store of value” assets, which we will cover in detail later in this letter.

This has come after a 30-year period in which very few investors globally had meaningful exposure to store of value assets in their portfolios. The change in trend has been extremely rapid, with gold rising 65% during 2025 and silver rising 147%. These are massive moves for assets with large market caps.

What are the key contenders for store of value assets

Gold

Silver

Other precious metals (platinum, palladium for example)

Other base metals (copper, nickel and the like

Other assets with limited supply (cryptocurrencies like Bitcoin)

High quality equities

Land / property

Most of you will know that we have very rarely invested in commodities during the past 27 years, doing so only in cases when exceptional opportunities emerged such as Thungela Coal from 2021 to 2023.

As the case became stronger to own store of value assets during 2025, we increased our exposure to gold miners, specifically Pan African Resources while also adding some PGM (Platinum Group Metals) miners to the portfolio.

As South Africans, we are probably most excited about the potential improvements we see in SA. We know domestic South African businesses very well and are finding great opportunities to play the recovery story. We hope the government takes advantage of the lucky hand we have been dealt and doesn’t squander this amazing opportunity for economic revival that we have been given.

On the global front, while there are real geopolitical concerns, we are living through what will likely be the most exciting time for technological development in human history. Productivity improvements from AI across the global economy could be immense over the next 5 years, and over long-term horizons, the impact of billions of humanoid robots automating many tasks will be just as incredible. What a time to be alive and to be an investor.

Our goal, as always, is to deliver consistent returns for investors without being benchmarked to any specific index or market. We believe that long-term wealth is created by compounding your assets year in, year out, in good markets and bad. It comes from avoiding major drawdowns on your capital, capturing the upside in good years, and avoiding major losses in bad years. This approach has worked well for our investors and us for 27 years, and we believe it will continue to deliver going forward. We look forward to navigating these most interesting of times.

It has been an extremely exciting time to manage money, with so many changes occurring worldwide and in SA.

We would summarise the key big picture trends as AI, store of value assets, and the South African recovery.

Given the more positive economic backdrop for South Africa and still moderate valuations, we increased our SA exposure during the last quarter of 2025. We added exposure to banks, retailers, and food producers, among others. The macroeconomic tailwinds haven’t quite translated into meaningful on-the-ground improvement in company results, but we think there is a very good chance that will start to happen during 2026.

It has been an extremely exciting time to manage money, with so many changes occurring worldwide and in SA. We would summarise the key big picture trends as AI, store of value assets, and the South African recovery. We own great companies behind each of these themes and are currently in the fortunate position where good ideas must fight to get into the portfolio.

Please contact us via ask@peregrine.co.za if you have any questions or comments.

With Thanks

Investor Letter

Fund Name | Inception date | Highest annual return | Lowest rolling annual return | Latest 1 year |

|---|---|---|---|---|

Vision Fund | Apr-2024 | 28.96% | 9.57% | 28.96% |

HFRX Equity Hedge Index | Apr-2024 | 10.06% | -0.8% | 10.06% |

Fund Name | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 5 years | Latest 15 years |

|---|---|---|---|---|---|---|

Pure Hedge Fund | Jul-1998 | 67.90% (1999) | 1.61% (2008) | 10.64% | 11.64% | 12.48% |

Inflation (CPI) | Jul-1998 | 12.97% (2002) | 0.21% (2008) | 3.49% | 4.95% | 5.40% |

ASISA South Africa MA Low Equity | Jul-1998 | 40.59% (1999) | -10.69% (2008) | 15.51% | 10.62% | 9.96% |

Fund Name | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 5 years | Latest 15 years |

|---|---|---|---|---|---|---|

High Growth Fund | Feb-00 | 53.01% (2004) | -11.98% (2008) | 14.67% | 15.03% | 17.07% |

ASISA South Africa MA High Equity | Feb-00 | 27.49% (2004) | -8.24% (2008) | 18.77% | 12.69% | 9.36% |

The calculation of all net returns from 1 February 2000 until 30 November 2016 relates to the Peregrine High Growth Fund, prior to its inclusion under CISCA. Thereafter, the data relates to the Peregrine Capital High Growth QI Hedge Fund (“High Growth Fund”). The calculation of all net returns from 1 July 1998 until 30 November 2016 relates to the Peregrine Pure Hedge Fund, prior to its inclusion under CISCA. Thereafter, the data relates to the Peregrine Capital Pure Hedge QI Hedge Fund (“Pure Hedge Fund”).

Data to 31 December 2025 | Source: Peregrine Capital, Morningstar, Bloomberg.

Important Information