Investor Letter

**Inception date is 1 July 1998

Returns are to 31 December 2024 | Source: Peregrine Capital, Morningstar

Market overview

We covered the South African market in some detail in our 2023 annual letter and in our semi-annual 2024 letter. The JSE Capped SWIX All Share Index delivered 13.4% for the year, a healthy return. The retail sector was the standout performer, benefiting from the favourable election outcome and increased consumer confidence. November and December retail trading also benefited from the cash infusion of the two-pot retirement system into the economy.

We are six months on from the formation of the Government of National Unity, and the broad coalition is still holding together. While sentiment has improved substantially, this has yet to translate into a material rebound in growth rates. Controversial legislation continues to be promulgated despite the ANC’s reduced share of the vote. Municipal governance continues to disappoint, and underinvestment in critical infrastructure is leading to more widespread service delivery issues. Water insecurity in key metros is at the top of residents' and companies' minds. Unemployment remains unacceptably high and persistent.

However, we are seeing real signs of improvement in other areas. The load-shedding turnaround, which we had seen as a likely outcome in our previous investor letters, has exceeded even our most optimistic expectations. At the time of writing, we have experienced 300 days without load-shedding. We are also encouraged by the progress at Transnet, where new leadership has brought stability, cooperation, and alignment with the private sector. While the turnaround will require more time, the early signs are promising. The Department of Home Affairs has promulgated regulations that make it easier for employers to attract rare foreign skills, and simpler for tourists to experience our beautiful country—two obvious GDP accelerators. The meaningful decline in the cost of South African government debt post-election is a major positive step for the country’s long-term fiscal health. While crime rates remain a major concern, we are seeing increased urgency and determination from SAPS, the SIU, and the Hawks. With these developments, we are hopeful that the momentum will continue to build, fostering further improvements and moving the needle on economic growth.

We covered the South African market in some detail in our 2023 annual letter and in our semi-annual 2024 letter. The JSE Capped SWIX All Share Index delivered 13.4% for the year, a healthy return. The retail sector was the standout performer, benefiting from the favourable election outcome and increased consumer confidence. November and December retail trading also benefited from the cash infusion of the two-pot retirement system into the economy.

We are six months on from the formation of the Government of National Unity, and the broad coalition is still holding together. While sentiment has improved substantially, this has yet to translate into a material rebound in growth rates. Controversial legislation continues to be promulgated despite the ANC’s reduced share of the vote. Municipal governance continues to disappoint, and underinvestment in critical infrastructure is leading to more widespread service delivery issues. Water insecurity in key metros is at the top of residents' and companies' minds. Unemployment remains unacceptably high and persistent.

However, we are seeing real signs of improvement in other areas. The load-shedding turnaround, which we had seen as a likely outcome in our previous investor letters, has exceeded even our most optimistic expectations. At the time of writing, we have experienced 300 days without load-shedding. We are also encouraged by the progress at Transnet, where new leadership has brought stability, cooperation, and alignment with the private sector. While the turnaround will require more time, the early signs are promising. The Department of Home Affairs has promulgated regulations that make it easier for employers to attract rare foreign skills, and simpler for tourists to experience our beautiful country—two obvious GDP accelerators. The meaningful decline in the cost of South African government debt post-election is a major positive step for the country’s long-term fiscal health. While crime rates remain a major concern, we are seeing increased urgency and determination from SAPS, the SIU, and the Hawks. With these developments, we are hopeful that the momentum will continue to build, fostering further improvements and moving the needle on economic growth.

If we take a moment to look back: Over the past 15 years, the High Growth Fund has returned 17.2% per annum versus 8.9% for the SA Multi-Asset High Equity Category and 9.9% for the JSE Capped SWIX All Share Index. Over the past 15 years, the best multi-asset fund out of the 53 in the category returned 10.89% per annum to investors. The High Growth Fund generated a cumulative 1,080% return over the period versus 371% for the next best fund. We outperformed the best other fund by more than 2.5x over the 15 years. Since its inception, this gap is even wider.To give you an idea of the impact of compounding outperformance over a long time, the 23.1% per annum since inception return for the High Growth Fund equates to 178x your money*, meaningfully better than any other fund in South Africa over that time.

*See the disclaimer at the end of the letter.

Consistent outperformance adds up spectacularly, and this is what we endeavour to achieve each year. We work incredibly hard to find specific opportunities that will provide outperformance and, ideally, also be uncorrelated to the rest of our portfolio. By constructing a portfolio of independently good ideas, we can generate a return stream that is above that of the market while having lower downside risk. Doing this year in and year out while avoiding drawdowns adds up to outsized success in the long run.

2024 was a productive year for the Peregrine Capital funds, with our High Growth and Pure Hedge funds delivering 22.0% and 15.8% net returns, respectively. This performance, one of our strongest in the past decade, is particularly gratifying given the challenges of navigating significant macroeconomic events, including the South African and US elections. We remain grateful for the trust and support of our clients, which continues to drive our disciplined approach and performance.

This performance, one of our strongest in the past decade, is particularly gratifying given the challenges of navigating significant macroeconomic events, including the South African and US elections.

2024 was another good year for global markets, with the MSCI World Index returning 17.4%. After a very difficult 2022, markets bounced back strongly in 2023 and 2024.

The major theme driving international markets was still Artificial Intelligence, or “AI”. We first wrote about this at the end of our 2022 letter, and the advances in AI have continued to accelerate in the past year. The so-called “Magnificent 7” has driven a meaningful part of the return of the US and global markets during the past year.

The wave of AI innovation has thus far greatly benefited large technology companies. Many of these firms are still led or influenced by their founders and possess the financial resources to invest the vast sums required to build data centres and acquire cutting-edge chips. We currently hold positions in Meta, Amazon, Microsoft, and Alphabet (Google), with further commentary provided later in this letter.

Watch Jacques Conradie and David Fraser talk about the 2024 funds’ performance:

We will cover a few specific opportunities that have been meaningful contributors to the funds and discuss some of the major market themes we see right now:

Estée Lauder

Fortress Real Estate

Artificial Intelligence (AI)

Steinhoff Preference Shares

Lessons Learned

A Unique Investment Opportunity

It is worth mentioning that our constructive engagement with the company did not stop once the capital structure was simplified. Our main focus for the year was to engage with the board and other shareholders to reset executive remuneration principles in a manner that aligns the interests of the executive with shareholders by rewarding per-share value creation. There is still a significant opportunity for Fortress to lead the property sector in maximising per-share returns for shareholders through rational and disciplined capital allocation. While we commend the executive team and the board for their fortitude over the past four years, we still see significant opportunity on the road ahead rather than in the rear-view mirror.

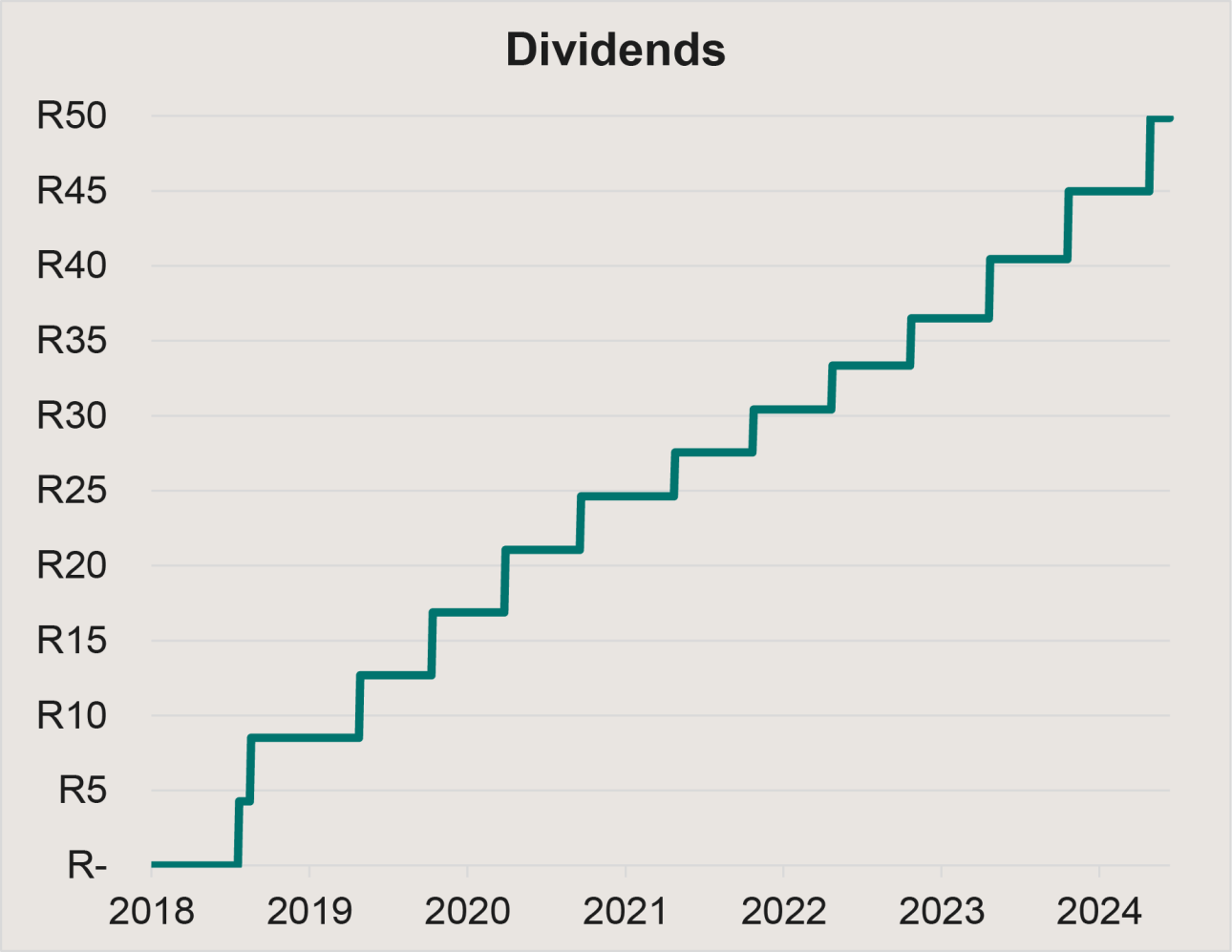

As a result of our analysis, this holding worked out exceptionally well. We received a total of R50 in dividends, and Steinhoff repurchased all the preference shares at R98 per share on 24 June 2024. Thus, our funds received a total of R148 per share in dividends and final sale proceeds on an instrument that we started buying at R20. Our total return was well above 30% per annum over our six-and-a-half-year holding period.

This case study highlights the value of hard work and detailed analysis, being willing to look for opportunities where others are not, and being patient while waiting for things to work out.

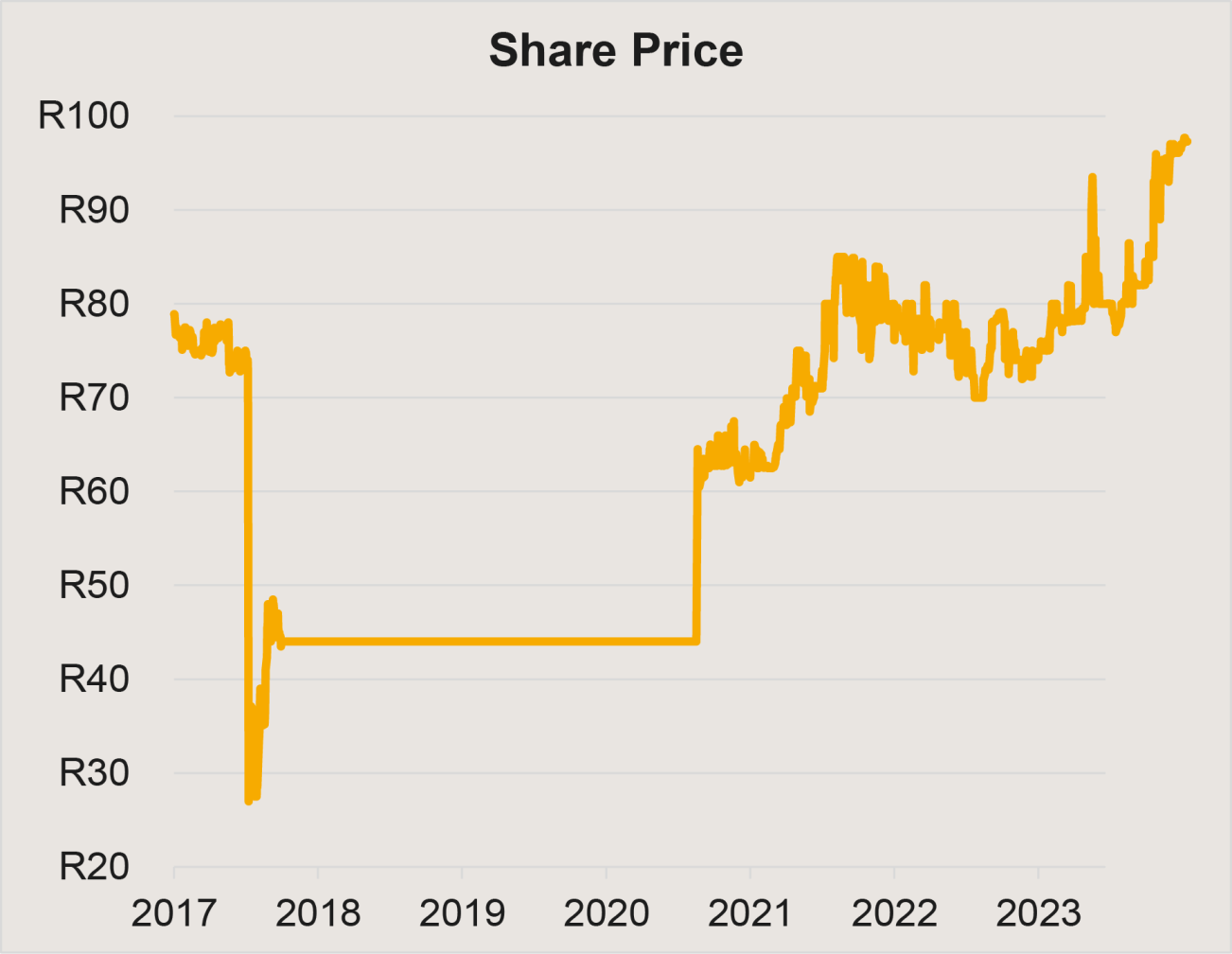

We bought our first Steinhoff preference shares at below R20 per share and continued to buy them in the market all the way from 2017 to 2023. Our detailed analysis indicated that the South African Steinhoff entity had no solvency or liquidity issues, and this ultimately proved correct. The value of our preference share was covered multiple times by the Pepkor shares owned by that entity, and Steinhoff continued to pay contractual dividends on the preference shares during the entire restructuring process because the South African entity was solvent and healthy.

We remain of the view that AI could well be the defining invention of this era. One cannot be exactly sure how fast the progress will be or how long it will continue. Still, it is truly staggering that we now have AIs capable of answering questions and engaging in conversations at the level of an intelligent human, infused with the knowledge of virtually everything that has ever happened. None of us would have believed this phenomenon was possible even three years ago.

All the AI beneficiaries we own had an extremely successful year in 2024. Using current expectations for 2024 full-year numbers, we estimate that Microsoft grew earnings by 17%, Meta by 38%, Google by 35%, and Amazon by more than 100%. These businesses have immensely strong competitive positions, huge customer bases, almost unlimited financial resources, and mostly have their founders intimately involved in the businesses, either directly or in the background. Valuation multiples are slightly higher than a year ago but are by no means stretched relative to history and when considering their future growth potential. It is difficult to predict exactly how earnings and multiples will evolve, but it seems highly likely that these businesses will continue to thrive in the years to come.

The benefits of AI are most evident for Meta, whose content generation and content recommendation capabilities have improved drastically, allowing them to show more relevant posts and ads that users are more likely to engage with, ultimately capturing more advertiser budgets. Google has seen similar improvements in its core search and YouTube businesses. We also own all the “hyperscalers” (Google, Amazon, and Microsoft) that provide the datacentres and GPUs required to operate all the underlying AI companies, which require ever-increasing compute power to run their operations. These businesses are positioned to win both directly and indirectly from the adoption of AI products and services.

We are extremely excited about what AI could mean for human potential and human prosperity. In time, it will benefit almost all areas of our lives. We are particularly excited about its potential to equalise access to education and bring transformative healthcare benefits. ChatGPT is already almost as good as the best teachers and will only improve – our various teams use it to dig deeper into topics almost daily. The product is free, so all children and students can access it! The other key potential is in healthcare. Once AI can operate close to PhD-level intelligence, we could see a golden age for medical research and discoveries over the next decade. Truly exciting times lie ahead.

As with any year, we always have a few losing positions. This is a part of investing, and we try to use these as learning opportunities to improve. One of our losing positions was Estée Lauder.

We entered the position about a year ago at around $140 per share, after the share was already down more than 60% from the peak of $370 achieved at the end of 2021.

Unfortunately, we bought the dip far too early. The company’s over-reliance on China, a key market for its high-margin skincare products, backfired when the country’s post-COVID recovery lagged. A sharp decline in travel retail, heavily reliant on Chinese tourism, further slowed inventory turnover. Weak demand forced product write-downs and discounting, severely impacting margins and leading to multiple quarters of missed guidance.

We underestimated the risks, attempting to call the bottom too early based on overly optimistic projections of "normalised" margins and earnings. We were too anchored to the high historic PE multiples this business traded at and ended up buying without enough margin of safety.

We ultimately sold the position at a material loss. The key lesson is to wait for a sufficient margin of safety when you are betting on a turnaround story. It is hard to assess whether management will be able to turn the business around, and the share price needs to be low enough to reward us substantially if the turnaround does come through. The upside scenarios need to compensate for the risk that the turnaround will take longer, or not materialise at all, in which case there could always be further downside risks. Fortunately, we run smaller positions in these kinds of opportunities, and the negative impact on returns for the year was only 0.5%.

You might wonder: How could Steinhoff have been an investment opportunity? Wasn’t it the biggest fraud in South Africa’s history? During the first half of the year, we fully realised our investment in the Steinhoff preference shares. This was an exceptionally successful investment for our funds and is worth discussing.

As a reminder, our funds had zero exposure to Steinhoff equity in the run-up to and during the disclosure of the events that unfolded there. We started building a position in the Steinhoff preference shares in early December 2017, days after the revelation of the Steinhoff fraud. This was during the week when Steinhoff's ordinary shares collapsed from R55 to R6 a share. The ordinary share eventually went all the way down to zero.

While most investors were running for the hills, we dropped everything to conduct in-depth work on Steinhoff to identify whether there were any opportunities for our funds. After some initial work on various Steinhoff debt instruments, we identified the Steinhoff JSE-listed preference share as a potential idea. This instrument differed from the Steinhoff debt or equity, in that it was issued not from Steinhoff International NV, where the fraud was perpetrated and where the vast majority of the debt resided, but from Steinhoff’s South African subsidiary.

What made this interesting to us was that this Steinhoff South African entity had virtually no external debt while at the same time owning a controlling shareholding in the JSE-listed Pepkor group. Pep is an amazing South African business with an honest, hardworking, and all-round exceptional management team. Pep had nothing to do with the fraud that Markus Jooste and his lieutenants had committed at the Steinhoff holding company level.

During the initial panic, market participants sold everything with Steinhoff in its name. This was actually the correct course of action in most cases (if you had Steinhoff shares, it was much better to sell them at R20 or R10 than holding them all the way to zero). However, they also sold down this preference share from the R75 level at which it was trading before the revelations, all the way down to R20 per share.

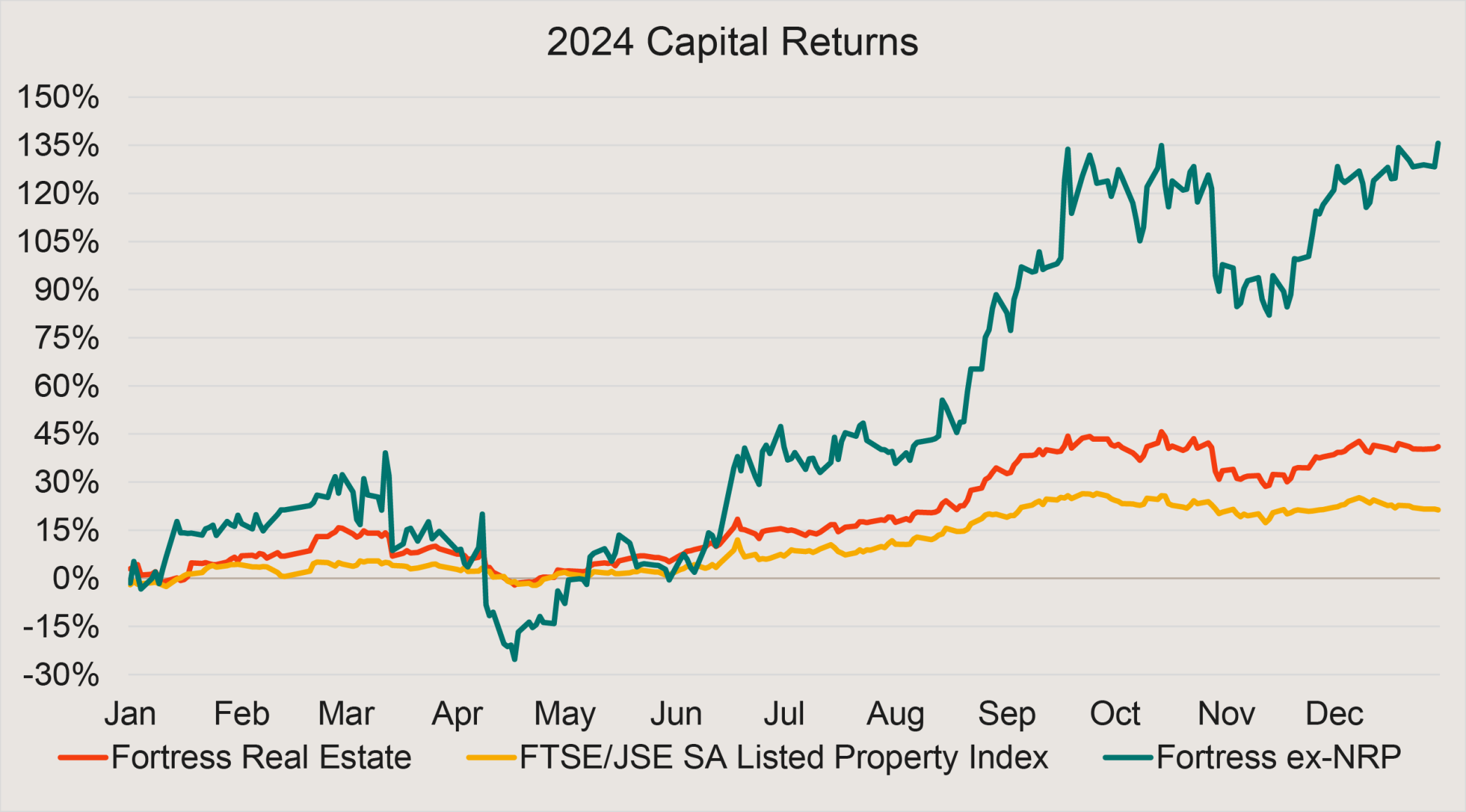

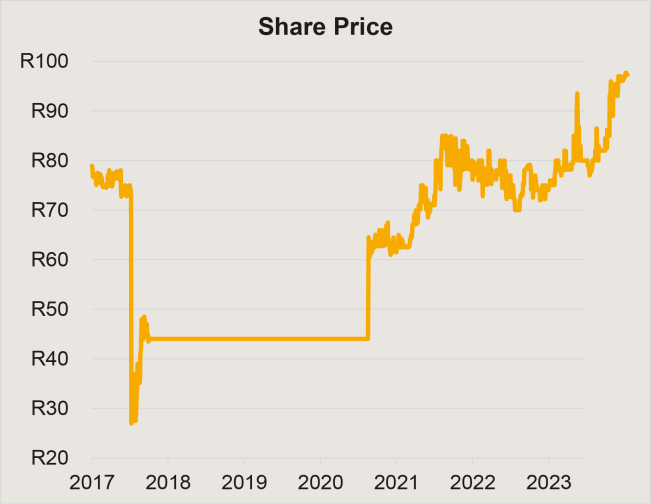

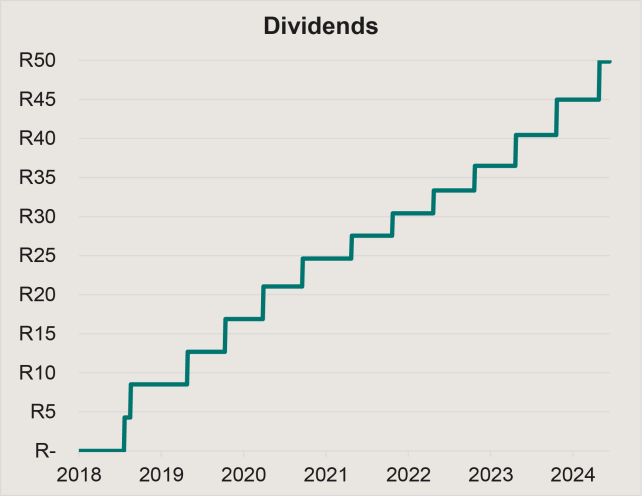

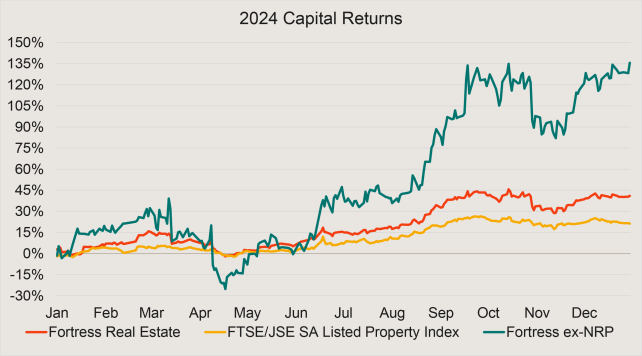

After meaningfully contributing to returns in 2023, Fortress retained the top spot on the list of performers for 2024. We mentioned in our 2023 annual letter that we still saw substantial value to be unlocked at Fortress after the simplification of the corporate structure on 14 February 2024.

Fortress has been shackled by its prescriptive capital structure for the better part of the last four years. The restructuring that resulted from our extensive engagement with fellow shareholders in the market helped free the company from this burden. Fortress was immediately able to resume dividend payments to shareholders, improving the attractiveness of the investment case for yield-sensitive property investors. In addition to realising a dividend yield of approximately 10%, the Fortress share price rallied by 41% for the year, which was impressive. However, this only tells half the story.

Fortress consists of two constituent parts: the significant investment in JSE-listed NEPI Rockcastle and its South African logistics and retail properties. NEPI Rockcastle delivered a capital return of 9% for the year in rands. In comparison, the SA properties, as measured by the Fortress return excluding their NEPI Rockcastle ownership, delivered a capital return of 136% for shareholders. As a hedge fund, our funds could construct a position that gave us direct exposure to the SA property portfolio—the component of Fortress that was most undervalued at that time. This capability is simply not available to long-only managers given their more limited toolset.

Source: 25/01/2018 to 12/06/2024 | Source: Peregrine Capital, Bloomberg

Source: 30/12/2016 to 12/06/2024 | Source: Peregrine Capital, Bloomberg

Source: Peregrine Capital, Bloomberg

Success is never a straight line upward, but you can rest assured that we are doing all we can to position the business to deliver great performance in the years to come.

We have a portfolio of attractive opportunities and continue to seek new ideas. We are confident that our consistent process and investment philosophy will continue to generate interesting and fresh ideas.

On the business side, we added four new investment analysts to our team during 2024 and have also grown team members in other areas. We are attracting some of the best and brightest young talent in South Africa. At its core, our business is driven by having the very best people, so our ability to attract exceptional talent sets the foundation for an exciting future. Success is never a straight line upward, but you can rest assured that we are doing all we can to position the business to deliver great performance in the years to come.

A key driver of our success over the past 26 years is having clients with a long-term mindset like ours. Your trust and backing enable us to pursue our passion for investing and to contribute to building your wealth with you. Many of you have been with us for years, and we believe this longstanding partnership has driven the growth of our investment funds. By placing your confidence in our approach and maintaining a long-term perspective, you empower us to make decisions that deliver consistent and attractive risk-adjusted returns over time. Our team is invested in the funds alongside you (collectively, we are the second-largest investor), and our goals are 100% aligned with yours. This alignment is unique in the South African fund management industry.

We have realised profits on some of our positions and currently sit at slightly below-average levels of market exposure. Global market multiples are above long-term averages, and we feel that slight caution is warranted. We are looking forward with great interest to seeing the impact that the new Trump presidency will have on the USA. It will be particularly interesting to observe the newly established Department of Government Efficiency (“DOGE”), which aims to reduce government spending and materially cut onerous regulations. It has become extremely clear how excessive regulatory intervention in the EU has stunted innovation in that economy, dragging down growth and economic prosperity. If DOGE successfully achieves its lofty ambitions, it may set the USA up for accelerated productivity growth in the decades to come, serving as a beacon for other governments to emulate.

With Thanks

Please contact us via info@peregrine.co.za if you have any questions or comments.

Fund | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 3 years | Latest 5 years | Latest 15 years | Since Inception |

|---|---|---|---|---|---|---|---|---|

High Growth Fund | Feb-00 | 53.01% (2004) | -11.98% (2008) | 22.00% | 15.98% | 15.49% | 17.22% | 23.14% |

SA Multi Asset - High Equity | Feb-00 | 47.25% (2005) | -23.23% (2008) | 13.41% | 8.32% | 9.97% | 8.89% | 10.51% |

FTSE/JSE Capped Swix All Share Index | Feb-00 | 27.49% (2004) | -8.24% (2008) | 13.41% | 8.50% | 10.30% | 9.89% | 12.10% |

Pure Hedge Fund | Jul-1998 | 67.90% (1999) | 1.61% (2008) | 15.78% | 13.72% | 11.95% | 12.53% | 18.91% |

Inflation (CPI) | Jul-1998 | 12.97% (2002) | 0.21% (2008) | 2.93% | 5.27% | 4.89% | 5.03% | 5.74% |

SA Multi Asset - Low Equity | Jul-1998 | 40.59% (1999) | -10.69% (2008) | 12.21% | 8.09% | 8.56% | 8.06% | 9.75% |

Important Information

The ‘JSE Capped Swix All Share Index’ referenced is the index from December 2016 to date; before that, the JSE All Share TR Index is used. The ‘Cash’ referenced is the STeFI Index (Stefocad) from July 2003 to date; before that, the JIBAR is used.

*178x refers to the Peregrine Capital High Growth H4 QI Hedge Fund. R1m invested at inception is worth more than R100m today, SA Multi Asset - High Equity Category: R12.1m, FTSE/JSE Capped SWIX: R17.2m. High Growth Fund annualised return: 23.14% | SA Multi Asset - High Equity Category annualised return: 10.51% | FTSE/JSE Capped SWIX annualised return: 12.10%, all since inception (February 2000).

Data to 31 December 2024 | Source: Peregrine Capital, Morningstar, Bloomberg

The ‘JSE Capped Swix All Share Index’ referenced is the index from December 2016 to date; before that, the JSE All Share TR Index is used. The ‘Cash’ referenced is the STeFI Index (Stefocad) from July 2003 to date; before that, the JIBAR is used. H4 Collective Investments (RF) Proprietary Limited (“H4”) is a registered and approved manager of collective investment schemes in hedge funds. Peregrine Capital Proprietary Limited (“Peregrine Capital”) is an authorised Financial Services Provider (FSP 607) under the Financial Advisory and Intermediary Services Act, No. 37 of 2002 and has been appointed by H4 as the investment manager of the portfolios.

Collective investment schemes are medium to long-term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from H4 or Peregrine Capital.

Peregrine Capital High Growth H4 QI Hedge Fund: Performance fees are payable on positive performance using a participation rate of 20%. A high watermark is applied, which ensures that performance fees will only be charged on new performance. There is no cap on the Rand amount of performance fees.Peregrine Capital Pure Hedge H4 QI Hedge Fund: Performance fees are payable on positive performance, in excess of the hurdle, using a participation rate of 20%. A high watermark is applied, which ensures that performance fees will only be charged on new performance. There is no cap on the Rand amount of performance fees.

Neither H4 nor Peregrine Capital provides any guarantee with respect to the capital or return of a portfolio. H4 retains full legal responsibility for the portfolios. H4 has the right to close the portfolios to new clients to manage them more efficiently in accordance with their mandates.

The performance calculated and shown is that of the portfolio. Performance has been calculated using net NAV-to-NAV numbers with income reinvested. The investment performance for each period shown reflects the net return for clients who have been fully invested for that period. Individual investor investment performance may differ as a result of initial fees (if applicable), the actual investment date, the date of reinvestment of distributions, and/or distribution dates and dividend withholding tax.

Where periods of longer than one year are used in calculating past performance, certain figures may be annualised. Annualised performance is the average return per year over the period. Actual annual figures and investment performance calculations are available upon request at info@h4ci.co.za. Investment performance calculations are available for verification upon request by any person.

Where investment performance has been shown by way of an illustration:

(a) investment performance is for illustrative purposes only;

(b) the investment performance is calculated by taking the actual initial fees and all ongoing fees into account for the amount shown; and

(c) income is reinvested on the reinvestment date.

The performance history is contained in the portfolios’ minimum disclosure documents, which are available on request from H4 or Peregrine Capital.

Investor Letter

Market overview

We covered the South African market in some detail in our 2023 annual letter and in our semi-annual 2024 letter. The JSE Capped SWIX All Share Index delivered 13.4% for the year, a healthy return. The retail sector was the standout performer, benefiting from the favourable election outcome and increased consumer confidence. November and December retail trading also benefited from the cash infusion of the two-pot retirement system into the economy.

We are six months on from the formation of the Government of National Unity, and the broad coalition is still holding together. While sentiment has improved substantially, this has yet to translate into a material rebound in growth rates. Controversial legislation continues to be promulgated despite the ANC’s reduced share of the vote. Municipal governance continues to disappoint, and underinvestment in critical infrastructure is leading to more widespread service delivery issues. Water insecurity in key metros is at the top of residents' and companies' minds. Unemployment remains unacceptably high and persistent.

However, we are seeing real signs of improvement in other areas. The load-shedding turnaround, which we had seen as a likely outcome in our previous investor letters, has exceeded even our most optimistic expectations. At the time of writing, we have experienced 300 days without load-shedding. We are also encouraged by the progress at Transnet, where new leadership has brought stability, cooperation, and alignment with the private sector. While the turnaround will require more time, the early signs are promising. The Department of Home Affairs has promulgated regulations that make it easier for employers to attract rare foreign skills, and simpler for tourists to experience our beautiful country—two obvious GDP accelerators. The meaningful decline in the cost of South African government debt post-election is a major positive step for the country’s long-term fiscal health. While crime rates remain a major concern, we are seeing increased urgency and determination from SAPS, the SIU, and the Hawks. With these developments, we are hopeful that the momentum will continue to build, fostering further improvements and moving the needle on economic growth.

2024 was another good year for global markets, with the MSCI World Index returning 17.4%. After a very difficult 2022, markets bounced back strongly in 2023 and 2024.

The major theme driving international markets was still Artificial Intelligence, or “AI”. We first wrote about this at the end of our 2022 letter, and the advances in AI have continued to accelerate in the past year. The so-called “Magnificent 7” has driven a meaningful part of the return of the US and global markets during the past year.

The wave of AI innovation has thus far greatly benefited large technology companies. Many of these firms are still led or influenced by their founders and possess the financial resources to invest the vast sums required to build data centres and acquire cutting-edge chips. We currently hold positions in Meta, Amazon, Microsoft, and Alphabet (Google), with further commentary provided later in this letter.

This performance, one of our strongest in the past decade, is particularly gratifying given the challenges of navigating significant macroeconomic events, including the South African and US elections.

2024 was a productive year for the Peregrine Capital funds, with our High Growth and Pure Hedge funds delivering 22.0% and 15.8% net returns, respectively. This performance, one of our strongest in the past decade, is particularly gratifying given the challenges of navigating significant macroeconomic events, including the South African and US elections. We remain grateful for the trust and support of our clients, which continues to drive our disciplined approach and performance.

**Inception date is 1 July 1998

Returns are to 31 December 2024 | Source: Peregrine Capital, Morningstar

Watch Jacques Conradie and David Fraser talk about the 2024 funds’ performance:

If we take a moment to look back: Over the past 15 years, the High Growth Fund has returned 17.2% per annum versus 8.9% for the SA Multi-Asset High Equity Category and 9.9% for the JSE Capped SWIX All Share Index. Over the past 15 years, the best multi-asset fund out of the 53 in the category returned 10.89% per annum to investors. The High Growth Fund generated a cumulative 1,080% return over the period versus 371% for the next best fund. We outperformed the best other fund by more than 2.5x over the 15 years. Since its inception, this gap is even wider.To give you an idea of the impact of compounding outperformance over a long time, the 23.1% per annum since inception return for the High Growth Fund equates to 178x your money*, meaningfully better than any other fund in South Africa over that time.

*See the disclaimer at the end of the letter.

Consistent outperformance adds up spectacularly, and this is what we endeavour to achieve each year. We work incredibly hard to find specific opportunities that will provide outperformance and, ideally, also be uncorrelated to the rest of our portfolio. By constructing a portfolio of independently good ideas, we can generate a return stream that is above that of the market while having lower downside risk. Doing this year in and year out while avoiding drawdowns adds up to outsized success in the long run.

Source: 25/01/2018 to 12/06/2024 | Source: Peregrine Capital, Bloomberg

Source: 30/12/2016 to 12/06/2024 | Source: Peregrine Capital, Bloomberg

Source: Peregrine Capital, Bloomberg

As with any year, we always have a few losing positions. This is a part of investing, and we try to use these as learning opportunities to improve. One of our losing positions was Estée Lauder.

We entered the position about a year ago at around $140 per share, after the share was already down more than 60% from the peak of $370 achieved at the end of 2021.

Unfortunately, we bought the dip far too early. The company’s over-reliance on China, a key market for its high-margin skincare products, backfired when the country’s post-COVID recovery lagged. A sharp decline in travel retail, heavily reliant on Chinese tourism, further slowed inventory turnover. Weak demand forced product write-downs and discounting, severely impacting margins and leading to multiple quarters of missed guidance.

We underestimated the risks, attempting to call the bottom too early based on overly optimistic projections of "normalised" margins and earnings. We were too anchored to the high historic PE multiples this business traded at and ended up buying without enough margin of safety.

We ultimately sold the position at a material loss. The key lesson is to wait for a sufficient margin of safety when you are betting on a turnaround story. It is hard to assess whether management will be able to turn the business around, and the share price needs to be low enough to reward us substantially if the turnaround does come through. The upside scenarios need to compensate for the risk that the turnaround will take longer, or not materialise at all, in which case there could always be further downside risks. Fortunately, we run smaller positions in these kinds of opportunities, and the negative impact on returns for the year was only 0.5%.

As a result of our analysis, this holding worked out exceptionally well. We received a total of R50 in dividends, and Steinhoff repurchased all the preference shares at R98 per share on 24 June 2024. Thus, our funds received a total of R148 per share in dividends and final sale proceeds on an instrument that we started buying at R20. Our total return was well above 30% per annum over our six-and-a-half-year holding period.

This case study highlights the value of hard work and detailed analysis, being willing to look for opportunities where others are not, and being patient while waiting for things to work out.

We bought our first Steinhoff preference shares at below R20 per share and continued to buy them in the market all the way from 2017 to 2023. Our detailed analysis indicated that the South African Steinhoff entity had no solvency or liquidity issues, and this ultimately proved correct. The value of our preference share was covered multiple times by the Pepkor shares owned by that entity, and Steinhoff continued to pay contractual dividends on the preference shares during the entire restructuring process because the South African entity was solvent and healthy.

You might wonder: How could Steinhoff have been an investment opportunity? Wasn’t it the biggest fraud in South Africa’s history? During the first half of the year, we fully realised our investment in the Steinhoff preference shares. This was an exceptionally successful investment for our funds and is worth discussing.

As a reminder, our funds had zero exposure to Steinhoff equity in the run-up to and during the disclosure of the events that unfolded there. We started building a position in the Steinhoff preference shares in early December 2017, days after the revelation of the Steinhoff fraud. This was during the week when Steinhoff's ordinary shares collapsed from R55 to R6 a share. The ordinary share eventually went all the way down to zero.

While most investors were running for the hills, we dropped everything to conduct in-depth work on Steinhoff to identify whether there were any opportunities for our funds. After some initial work on various Steinhoff debt instruments, we identified the Steinhoff JSE-listed preference share as a potential idea. This instrument differed from the Steinhoff debt or equity, in that it was issued not from Steinhoff International NV, where the fraud was perpetrated and where the vast majority of the debt resided, but from Steinhoff’s South African subsidiary.

What made this interesting to us was that this Steinhoff South African entity had virtually no external debt while at the same time owning a controlling shareholding in the JSE-listed Pepkor group. Pep is an amazing South African business with an honest, hardworking, and all-round exceptional management team. Pep had nothing to do with the fraud that Markus Jooste and his lieutenants had committed at the Steinhoff holding company level.

During the initial panic, market participants sold everything with Steinhoff in its name. This was actually the correct course of action in most cases (if you had Steinhoff shares, it was much better to sell them at R20 or R10 than holding them all the way to zero). However, they also sold down this preference share from the R75 level at which it was trading before the revelations, all the way down to R20 per share.

It is worth mentioning that our constructive engagement with the company did not stop once the capital structure was simplified. Our main focus for the year was to engage with the board and other shareholders to reset executive remuneration principles in a manner that aligns the interests of the executive with shareholders by rewarding per-share value creation. There is still a significant opportunity for Fortress to lead the property sector in maximising per-share returns for shareholders through rational and disciplined capital allocation. While we commend the executive team and the board for their fortitude over the past four years, we still see significant opportunity on the road ahead rather than in the rear-view mirror.

After meaningfully contributing to returns in 2023, Fortress retained the top spot on the list of performers for 2024. We mentioned in our 2023 annual letter that we still saw substantial value to be unlocked at Fortress after the simplification of the corporate structure on 14 February 2024.

Fortress has been shackled by its prescriptive capital structure for the better part of the last four years. The restructuring that resulted from our extensive engagement with fellow shareholders in the market helped free the company from this burden. Fortress was immediately able to resume dividend payments to shareholders, improving the attractiveness of the investment case for yield-sensitive property investors. In addition to realising a dividend yield of approximately 10%, the Fortress share price rallied by 41% for the year, which was impressive. However, this only tells half the story.

Fortress consists of two constituent parts: the significant investment in JSE-listed NEPI Rockcastle and its South African logistics and retail properties. NEPI Rockcastle delivered a capital return of 9% for the year in rands. In comparison, the SA properties, as measured by the Fortress return excluding their NEPI Rockcastle ownership, delivered a capital return of 136% for shareholders. As a hedge fund, our funds could construct a position that gave us direct exposure to the SA property portfolio—the component of Fortress that was most undervalued at that time. This capability is simply not available to long-only managers given their more limited toolset.

We will cover a few specific opportunities that have been meaningful contributors to the funds and discuss some of the major market themes we see right now:

A Unique Investment Opportunity

Lessons Learned

We remain of the view that AI could well be the defining invention of this era. One cannot be exactly sure how fast the progress will be or how long it will continue. Still, it is truly staggering that we now have AIs capable of answering questions and engaging in conversations at the level of an intelligent human, infused with the knowledge of virtually everything that has ever happened. None of us would have believed this phenomenon was possible even three years ago.

All the AI beneficiaries we own had an extremely successful year in 2024. Using current expectations for 2024 full-year numbers, we estimate that Microsoft grew earnings by 17%, Meta by 38%, Google by 35%, and Amazon by more than 100%. These businesses have immensely strong competitive positions, huge customer bases, almost unlimited financial resources, and mostly have their founders intimately involved in the businesses, either directly or in the background. Valuation multiples are slightly higher than a year ago but are by no means stretched relative to history and when considering their future growth potential. It is difficult to predict exactly how earnings and multiples will evolve, but it seems highly likely that these businesses will continue to thrive in the years to come.

The benefits of AI are most evident for Meta, whose content generation and content recommendation capabilities have improved drastically, allowing them to show more relevant posts and ads that users are more likely to engage with, ultimately capturing more advertiser budgets. Google has seen similar improvements in its core search and YouTube businesses. We also own all the “hyperscalers” (Google, Amazon, and Microsoft) that provide the datacentres and GPUs required to operate all the underlying AI companies, which require ever-increasing compute power to run their operations. These businesses are positioned to win both directly and indirectly from the adoption of AI products and services.

We are extremely excited about what AI could mean for human potential and human prosperity. In time, it will benefit almost all areas of our lives. We are particularly excited about its potential to equalise access to education and bring transformative healthcare benefits. ChatGPT is already almost as good as the best teachers and will only improve – our various teams use it to dig deeper into topics almost daily. The product is free, so all children and students can access it! The other key potential is in healthcare. Once AI can operate close to PhD-level intelligence, we could see a golden age for medical research and discoveries over the next decade. Truly exciting times lie ahead.

Success is never a straight line upward, but you can rest assured that we are doing all we can to position the business to deliver great performance in the years to come.

We have a portfolio of attractive opportunities and continue to seek new ideas. We are confident that our consistent process and investment philosophy will continue to generate interesting and fresh ideas.

On the business side, we added four new investment analysts to our team during 2024 and have also grown team members in other areas. We are attracting some of the best and brightest young talent in South Africa. At its core, our business is driven by having the very best people, so our ability to attract exceptional talent sets the foundation for an exciting future. Success is never a straight line upward, but you can rest assured that we are doing all we can to position the business to deliver great performance in the years to come.

A key driver of our success over the past 26 years is having clients with a long-term mindset like ours. Your trust and backing enable us to pursue our passion for investing and to contribute to building your wealth with you. Many of you have been with us for years, and we believe this longstanding partnership has driven the growth of our investment funds. By placing your confidence in our approach and maintaining a long-term perspective, you empower us to make decisions that deliver consistent and attractive risk-adjusted returns over time. Our team is invested in the funds alongside you (collectively, we are the second-largest investor), and our goals are 100% aligned with yours. This alignment is unique in the South African fund management industry.

We have realised profits on some of our positions and currently sit at slightly below-average levels of market exposure. Global market multiples are above long-term averages, and we feel that slight caution is warranted. We are looking forward with great interest to seeing the impact that the new Trump presidency will have on the USA. It will be particularly interesting to observe the newly established Department of Government Efficiency (“DOGE”), which aims to reduce government spending and materially cut onerous regulations. It has become extremely clear how excessive regulatory intervention in the EU has stunted innovation in that economy, dragging down growth and economic prosperity. If DOGE successfully achieves its lofty ambitions, it may set the USA up for accelerated productivity growth in the decades to come, serving as a beacon for other governments to emulate.

Please contact us via info@peregrine.co.za if you have any questions or comments.

With Thanks

Investor Letter

Fund | Inception date | Highest annual return | Lowest annual return | Latest 1 year | Latest 3 years | Latest 5 years | Latest 15 years | Since Inception |

|---|---|---|---|---|---|---|---|---|

High Growth Fund | Feb-00 | 53.01% (2004) | -11.98% (2008) | 22.00% | 15.98% | 15.49% | 17.22% | 23.14% |

SA Multi Asset - High Equity | Feb-00 | 47.25% (2005) | -23.23% (2008) | 13.41% | 8.32% | 9.97% | 8.89% | 10.51% |

FTSE/JSE Capped Swix All Share Index | Feb-00 | 27.49% (2004) | -8.24% (2008) | 13.41% | 8.50% | 10.30% | 9.89% | 12.10% |

Pure Hedge Fund | Jul-1998 | 67.90% (1999) | 1.61% (2008) | 15.78% | 13.72% | 11.95% | 12.53% | 18.91% |

Inflation (CPI) | Jul-1998 | 12.97% (2002) | 0.21% (2008) | 2.93% | 5.27% | 4.89% | 5.03% | 5.74% |

SA Multi Asset - Low Equity | Jul-1998 | 40.59% (1999) | -10.69% (2008) | 12.21% | 8.09% | 8.56% | 8.06% | 9.75% |

The ‘JSE Capped Swix All Share Index’ referenced is the index from December 2016 to date; before that, the JSE All Share TR Index is used. The ‘Cash’ referenced is the STeFI Index (Stefocad) from July 2003 to date; before that, the JIBAR is used.

*178x refers to the Peregrine Capital High Growth H4 QI Hedge Fund. R1m invested at inception is worth more than R100m today, SA Multi Asset - High Equity Category: R12.1m, FTSE/JSE Capped SWIX: R17.2m. High Growth Fund annualised return: 23.14% | SA Multi Asset - High Equity Category annualised return: 10.51% | FTSE/JSE Capped SWIX annualised return: 12.10%, all since inception (February 2000).

Data to 31 December 2024 | Source: Peregrine Capital, Morningstar, Bloomberg

Important Information

The ‘JSE Capped Swix All Share Index’ referenced is the index from December 2016 to date; before that, the JSE All Share TR Index is used. The ‘Cash’ referenced is the STeFI Index (Stefocad) from July 2003 to date; before that, the JIBAR is used. H4 Collective Investments (RF) Proprietary Limited (“H4”) is a registered and approved manager of collective investment schemes in hedge funds. Peregrine Capital Proprietary Limited (“Peregrine Capital”) is an authorised Financial Services Provider (FSP 607) under the Financial Advisory and Intermediary Services Act, No. 37 of 2002 and has been appointed by H4 as the investment manager of the portfolios.

Collective investment schemes are medium to long-term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. Collective investment schemes are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from H4 or Peregrine Capital.

Peregrine Capital High Growth H4 QI Hedge Fund: Performance fees are payable on positive performance using a participation rate of 20%. A high watermark is applied, which ensures that performance fees will only be charged on new performance. There is no cap on the Rand amount of performance fees.Peregrine Capital Pure Hedge H4 QI Hedge Fund: Performance fees are payable on positive performance, in excess of the hurdle, using a participation rate of 20%. A high watermark is applied, which ensures that performance fees will only be charged on new performance. There is no cap on the Rand amount of performance fees.

Neither H4 nor Peregrine Capital provides any guarantee with respect to the capital or return of a portfolio. H4 retains full legal responsibility for the portfolios. H4 has the right to close the portfolios to new clients to manage them more efficiently in accordance with their mandates.

The performance calculated and shown is that of the portfolio. Performance has been calculated using net NAV-to-NAV numbers with income reinvested. The investment performance for each period shown reflects the net return for clients who have been fully invested for that period. Individual investor investment performance may differ as a result of initial fees (if applicable), the actual investment date, the date of reinvestment of distributions, and/or distribution dates and dividend withholding tax.

Where periods of longer than one year are used in calculating past performance, certain figures may be annualised. Annualised performance is the average return per year over the period. Actual annual figures and investment performance calculations are available upon request at info@h4ci.co.za. Investment performance calculations are available for verification upon request by any person.

Where investment performance has been shown by way of an illustration:

(a) investment performance is for illustrative purposes only;

(b) the investment performance is calculated by taking the actual initial fees and all ongoing fees into account for the amount shown; and

(c) income is reinvested on the reinvestment date.

The performance history is contained in the portfolios’ minimum disclosure documents, which are available on request from H4 or Peregrine Capital.